- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Kinross (KGC) Gets Mining Rights Adjacent To Fort Knox

Kinross Gold Corporation (NYSE:KGC) declared that it has gained mining rights to a 709 acre land known as Gilmore, which is located near its Fort Knox mine in Alaska. The move allowed the company to add 2.1 million gold ounces in estimated indicated and measured resources and 300,000 ounces in estimated inferred resources at Fort Knox.

Kinross started an initial drilling program on Gilmore land and Fort Knox land in 2014. It targeted potential opportunities at the existing Fort Knox orebody, which continues west, and completed roughly 73,000 meters of core and reverse-circulation drilling in 205 holes.

The company also converted roughly 260,000 ounces of mineral resources from the East wall of the Fort Knox pit into probable and proven reserves, which offset some of the reserve depletion in 2017 and resulted in an increase to Fort Knox's estimated mine life by about a year.

Kinross expects to provide an update on the Gilmore feasibility study in mid-2018. The study analyzes a layback of the present Fort Knox pit to access known mineralization on Gilmore and Fort Knox land to potentially extend mine life. The company also expects to start the permitting process for mining at Gilmore by the end of year.

According to Kinross, Gilmore is a promising organic development opportunity that can extend mine life at Fort Knox, one of its top producing and high performing operations. With this move, the company will continue to deliver on its strategy of pursuing high-potential, low-risk brownfield projects that can contribute to its long-term future growth.

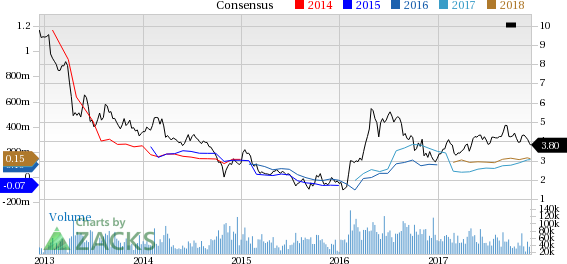

Shares of Kinross have lost 20.8% in the past three months, underperforming the industry’s 12.5% decline.

Kinross, in November, announced that it is on track to achieve towards the top end of its earlier announced gold production guidance range of 2.5-2.7 million gold equivalent ounces for 2017. The overall production cost of sales and all-in sustaining cost are also tracking towards the bottom end of the earlier announced guidance range of $660-$720 per gold equivalent ounce and $925-$1,025 per gold equivalent ounce, respectively.

Kinross is making steady progress in advancing the projects that give it a strong growth profile. The company also remains focused on managing costs, which is reflected by a decline in all-in sustaining costs in the last reported quarter.

Zacks Rank & Stocks to Consider

Kinross currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Westlake Chemical Corporation (NYSE:WLK) , Daqo New Energy Corp. (NYSE:DQ) and Kronos Worldwide Inc. (NYSE:KRO) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Westlake Chemical has an expected long-term earnings growth rate of 10.6%. Its shares have moved up 80.2% year to date.

Daqo New Energy has an expected long-term earnings growth rate of 7%. Its shares have surged a whopping 162.2% year to date.

Kronos Worldwide has an expected long-term earnings growth rate of 5%. Its shares have rallied 115.8% year to date.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

DAQO New Energy Corp. (DQ): Free Stock Analysis Report

Kinross Gold Corporation (KGC): Free Stock Analysis Report

Original post

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.