- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Keysight (KEYS) 5G NR Test Solutions To Be Used By DEKRA

Keysight Technologies Inc. (NYSE:KEYS) recently announced that its test solutions have been adopted by DEKRA for the certification of 5G New Radio (NR) and vehicle-to-everything (V2X) devices.

DEKRA will use Keysight’s solutions to ensure that 5G devices are safe for human interaction and are in compliance with various regulatory bodies like the 3GPP and the Federal Communications Commission (FCC).

The company’s 5G NR test solutions provide comprehensive certification testing for next-generation devices equipped with 5G NR connectivity.

Robust adoption of the company’s test solutions boosts its top-line growth.

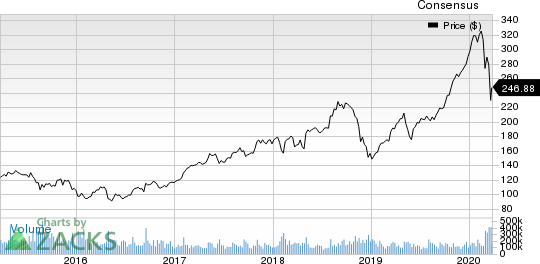

Keysight Technologies Inc. Price and Consensus

High Demand to Favor Business Prospects

Keysight’s 5G NR test solutions have been witnessing solid demand in recent times. Markedly, the company’s solutions suite was also adopted by major U.S. mobile operators to validate more than 600 test cases for their respective 5G NR device acceptance plans.

Moreover, Keysight’s solutions were selected by Korea Testing Laboratory and the Global Certification Forum for the certification of 5G NR devices.

Further, the company extended its collaboration with China Academy of Information and Communications Technology (CAICT) to accelerate the 5G new radio (NR) base station performance test plan in the country.

On the back of ongoing deal wins, we believe Keysight is well positioned to address the 5G endpoint installed base market, which per MarketsAndMarkets, is expected to witness a CAGR of 55.4% between 2020 and 2025, primarily driven by the acceleration in 5G investment.

COVID-19 Likely to be a Headwind

Nevertheless, the global COVID-19 pandemic is expected to have negatively impacted Keysight’s growth ambitions

Notably, the company recently provided an updated outlook stating it may not be able to meet its guidance for second-quarter fiscal 2020, as it has been forced to temporarily shut down several of its global locations due to the outbreak.

However, amid the market disruptions and uncertainty, Keysight’s focus on emerging markets like IoT and high-speed data centers holds promise. Additionally, medical devices and pharmaceutical markets hold immense potential courtesy of growing usage of electronics-based testing equipment.

Further, as employees are being forced to work from home due to the COVID-19 pandemic, there is an increasing demand for high-speed connectivity. As a result, Keysight’s investments in 5G and IoT are likely to favor its growth prospects in the days ahead.

Zacks Rank & Stocks to Consider

Currently, Keysight carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are SAP SE (NYSE:SAP) , Garmin Ltd. (NASDAQ:GRMN) and Microsoft Corporation (NASDAQ:MSFT) . All three stocks sport a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for SAP, Garmin and Microsoft is currently pegged at 9.5%, 7.4% and 13.2%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Microsoft Corporation (MSFT): Free Stock Analysis Report

Garmin Ltd. (GRMN): Free Stock Analysis Report

SAP SE (SAP): Free Stock Analysis Report

Keysight Technologies Inc. (KEYS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.