- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

JD.com (JD) Q4 Earnings Miss Estimates, Revenues Improve Y/Y

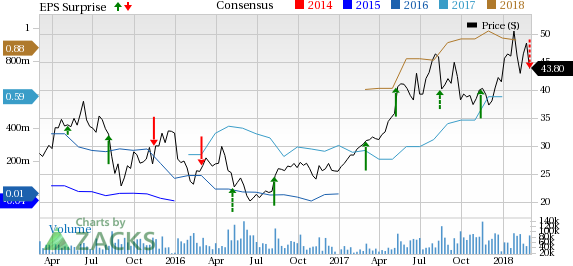

JD.com, Inc. (NASDAQ:JD) reported fourth-quarter earnings of 5 cents per share, missing the Zacks Consensus Estimate of 9 cents.

Earnings were impacted by increasing investments in new business lines including logistics investments, overseas expansion, artificial intelligence and cloud services. Order fulfillment expenses and technology costs increased year over year.

However, its fourth-quarter revenues came in above the Zacks Consensus Estimate of US$16.6 billion.

The company continued to invest in order to expand its fulfillment capability and broaden product offerings to enhance services offered to sellers on its marketplace platform to ensure long-term growth. As of Dec 31, 2017, the company operated 486 warehouses covering an aggregate gross floor area of approximately 10 million square meters in China.

Following fourth-quarter earnings release on Mar 2, its shares were down 5.2%. Also, the company's shares have gained 44% in a year’s time, underperforming the industry’s of 50.9%.

Revenues

JD.com reported revenues of RMB110.2 billion (US$16.9 billion), increasing 38.7% year over year. The reported figure was above the Zacks Consensus Estimate of US$16.6 billion. The increase was driven by strong revenues from both online direct sales as well as services.

In the fourth quarter, net revenues from online direct sales increased 37.3% from the prior-year quarter to RMB100.1 billion (US$15.4 billion). It accounted for 91% of total third-quarter sales. The improvement was driven by demand for home appliances, food and beverage, cosmetics, home furnishing and baby products.

Meanwhile, net revenues from services and others were up 54.7% year over year to RMB10 billion (US$1.5 billion). The upswing can be attributed to improved brand engagement and better monetization of the company’s platform. It accounted for the remaining 9% of third-quarter sales.

Key Metric

Annual Active Customer Accounts – Annual active customer accounts were 292.5 million in the 12-month period ended Dec 31, 2017, reflecting 29.1% year-over-year growth.

Operating Results

Pro forma gross margin was 12.9%, down 50 bps from the year-ago quarter.

Total operating expenses increased 41% year over year. Non-GAAP operating margin from continuing operations was -0.5% versus 0.7% in the year-ago quarter.

On a GAAP basis, JD.com generated net income of RMB909.2 million (US$139.7 million), down 27.9% from the prior-year quarter.

JD.com generated adjusted net income of RMB419.3 million (US$69.1 million), down 43% from the year-ago quarter.

Balance Sheet

JD.com exited the fourth quarter with cash, cash equivalents, restricted cash and short-term investments of approximately RMB38.4 billion (US$5.9 billion) compared with RMB41.8 billion (US$6.3 billion) in the prior quarter.

Guidance

For the first quarter of 2018, management expects net revenues to be in the range of RMB98-RMB100 billion, reflecting growth rate between 30% and 33% year over year.

This guidance excludes the impact from JD Finance for the 2017 period.

Zacks Rank and Stocks to Consider

JD.com has a Zacks Rank #3 (Hold). A few better-ranked stocks in the technology sector are PetMed Express (NASDAQ:PETS) , Teradyne (NYSE:TER) and Brady Corporation (NYSE:BRC) . While PetMed and Teradyne sport a Zacks Rank #1 (Strong Buy), Brady Corporation carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings per share growth rate for PetMed, Teradyne and Brady Corporation is projected to be 10%, 12% and 7.5%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

JD.com, Inc. (JD): Free Stock Analysis Report

Brady Corporation (BRC): Free Stock Analysis Report

Teradyne, Inc. (TER): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.