- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Jacobs' (JEC) CH2M Buyout Approved By CH2M Shareholders

Jacobs Engineering Group Inc. (NYSE:JEC) and CH2M HILL Companies, Ltd. announced on Dec 13, that approximately 95.6% of CH2M HILL’s stockholders have approved the acquisition of CH2M HILL by Jacobs. The deal will be executed through a reverse subsidiary merger.

This deal was originally announced on Aug 2.

Update on the Acquisition Deal: Preliminary Results

In addition, the companies gave preliminary results of the merger consideration election held on the date. CH2M HILL’s stockholders, of record as on Dec 15, 2017, were to choose one of the three consideration options as their preferred mode of payment in exchange of each share held by them. The options included the Mixed Election Consideration — cash of $52.85 and 0.6677 of Jacob’s shares, the Cash Election Consideration — cash of $88.08, and the Stock Election Consideration — 1.6693 of Jacob’s shares.

As noted, shareholders holding approximately 9.3% of CH2M HILLS shares voted for the Mixed Election Consideration, 21.5% for the Cash Election Consideration and 66.8% for the Stock Election Consideration. Also, shareholders of roughly 2.4% shares did not make valid election and were considered to have chosen the Mixed Election Consideration. Based on these preliminary results, proration is likely be applied to the shareholders opting for the Stock Election Consideration.

What CH2M Buyout Means for Jacobs?

Per the agreement signed in August, Jacobs’ acquisition of CH2M HILLS will cost the company approximately $2.85 billion, of which roughly 60% will be paid in cash and the rest 40% in the form of shares. Upon completion of the transaction, CH2M HILLS shareholders will hold approximately 15% of Jacobs’ shares. As regard to the cash portion, Jacobs intends to finance $2.4 billion cash through cash on hand, existing revolving credit facility and new debt arrangements.

The acquisition will make Jacobs a premier $15 billion global solutions provider. It will widen the company’s product offerings to existing and new clients while will gain easy access to unexplored markets.

The company anticipates annual cost savings of $150 million by the end of the second year following the deal closure while related one-time costs are likely to amount to $225 million. By the end of the first year following the deal completion, the company anticipates the acquired assets to boost its adjusted cash earnings per share by 25% and earnings per share by 15%.

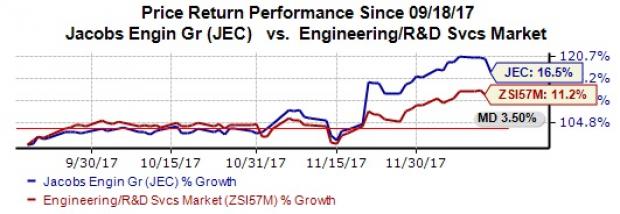

In the last three months, Jacob’s shares have yielded roughly 16.5% return, outperforming 11.2% gain of the industry it belongs to.

Zacks Rank and Key Picks

With approximately $8 billion market capitalization, Jacobs currently carries a Zacks Rank #3 (Hold). In the last 60 days, earnings estimates for the stock remained stable for both fiscal 2018 and fiscal 2019 at $3.44 and $3.82, respectively.

Jacobs Engineering Group Inc. Price and Consensus

Universal Forest Products, Inc. (UFPI): Free Stock Analysis Report

Jacobs Engineering Group Inc. (JEC): Free Stock Analysis Report

KBR, Inc. (KBR): Free Stock Analysis Report

Willdan Group, Inc. (WLDN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.