- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Is There Potential In AUD And CAD Demand?

Forex News and Events:

The RBA kept its cash rate unchanged at the historical low of 2.50% as widely expected. The sequence of slowdown in Chinese growth, the drop in mining investments and the significant decline in commodity prices – all combined to Australian government’s budget consolidation - require the extension of the period of lower rates for some more time in Australia. This is the only way for the RBA to ensure a healthy structural shift from mining to construction, especially with Aussie being considered as over-valued by historical means. In his speech post-decision, the Governor Stevens reiterated that high AUD offers “less assistance achieving balanced growth in the economy”.

Despite above-stated difficulties, the central bank data showed that the loose monetary policy and low borrowing costs sustain recovery through better lending and fastest credit growth. The private-sector credit expanded by 4.7% y/y in May, thus recording the fastest growth since Mach 2009, the GDP grew 3.5% in Q1 from a year earlier, while the unemployment rate retreated to 5.8% after hitting 6.0% at the beginning of the year. In addition, the June data recorded 1.4% rebound in house prices (vs. -1.9% drop a month ago). Stevens pointed at signs of improvement in the labor market warning that “it will probably take some time before unemployment declines consistently”, while adding that the growth should stay “a little below trend over the year ahead”. Traders continue betting on lower RBA rates before the year-end.

What’s the upside potential in AUD/USD?

AUD/USD rallied to 1.6463 (fresh year-to-date high) amid Stevens kept the balanced tone pulling RBA doves temporarily off the game. In addition, good PMI reading out of China reinforced the bullish momentum in Asia. However, the recent AUD-appetite and the remaining upside potential are highly contingent on international factors. First, the sequence of disappointing economic data out of the US prevents any sustainable pick-up in USD and, in addition, encourages the capital inflows towards relatively high yielding commodity currencies and EM. Given the trading environment, AUD/USD could easily make it higher, but for how long? The pair gained almost 10% since January 24th, the three month risk reversals are currently priced at 5-year highs. Technically, May-Jun ascending triangle suggests the extension of strength towards 0.9500 (Fibonacci 76.4% on heavy Oct’13 – Jan’14 drop). In the longer-run however, the forward curve anticipates a bearish reversal, well in line with lower RBA rate expectations against normalization abroad (Fed, RBNZ).

USD/CAD tops as Canadian growth misses expectations

The Canadian GDP readings missed the market expectations in April; GDP m/m grew 0.1% (vs 0.2% exp. & 0.1% last), GDP y/y remained flat at 2.1% (vs. 2.3% expected). USD/CAD rallied to 1.0697 forming a double top post-GDP (Friday &Monday high at 1.0697). The overall bias remains CAD-positive, although the April growth figures temper the BoC hawks giving reason to central banks’ recent comments on the inflation. The above-the-target (2.0%) inflation printed in May is transitory according to the BoC, rather than a sign of faster recovery. Canada will release May international merchandise trade figures on July 3rd; the consensus leans towards narrower deficit eyed at CAD -0.30bn versus -0.64bn printed in April. The surprise drop in April is believed to be due to significant decline in energy exports amid refinery shutdowns. We believe the risk of further drop still exists, yet the pick-up in energy prices through May give hope for improved trade balance. USD/CAD trades in the mid-range of 1.0550/1.0800 band (December 2013 transitory zone). A second month of deeper deficit should send USD/CAD to short-term corrective phase. Indeed, exports stand for one third of Canadian economy and the contraction of exports can only prevent BoC from moving the interest rates up from the current 1.0% any time soon. Option related offers are negatively skewed below 1.0800 and are likely to keep the upside capped for the moment. BoC meets on July 16th.

Today's Key Issues (time in GMT):

2014-07-01T13:45:00 USD Jun F Markit US Manufacturing PMI, exp 57.5, last 57.52014-07-01T14:00:00 USD Jun ISM Manufacturing, exp 55.9, last 55.4

2014-07-01T14:00:00 USD Jun ISM Prices Paid, exp 60, last 60

2014-07-01T14:00:00 USD Construction Spending annual revisions

2014-07-01T14:00:00 USD May Construction Spending MoM, exp 0.50%, last 0.20%

2014-07-01T14:00:00 USD Jul IBD/TIPP Economic Optimism, exp 48, last 47.7

2014-07-01T16:00:00 EUR Jun New Car Registrations YoY, last -3.83%

The Risk Today:

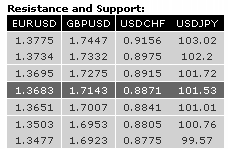

EUR/USD has broken to upside out of its horizontal range defined by 1.3503 and 1.3677. The short-term bullish momentum is intact as long as the hourly support at 1.3651 (previous resistance) holds. Resistances now stand at 1.3734 and 1.3775. In the longer term, the break of the long-term rising wedge (see also the support at 1.3673) indicates a clear deterioration of the technical structure. A long-term downside risk at 1.3379 (implied by the double-top formation) is favoured as long as prices remain below the resistance at 1.3775. Key supports can be found at 1.3477 (03/02/2014 low) and 1.3296 (07/11/2013 low).

GBP/USD has broken the major resistance at 1.7043. A short-term bullish bias is favoured as long as the hourly support at 1.7007 (27/06/2014 low) holds. Another support lies at 1.6953 (25/06/2014 low). In the longer term, the break of the major resistance at 1.7043 (05/08/2009 high) calls for further strength. Resistances can be found at 1.7332 (see the 50% retracement of the 2008 decline) and 1.7447 (11/09/2008 low). A support lies at 1.6923 (18/06/2014 low).

USD/JPY has broken the support implied by the 200 day moving average, confirming persistent selling pressures. A further decline towards the strong support at 100.76 is likely. Hourly resistances stand at 101.74 (27/06/2014 high) and 101.89 (26/06/2014 high, see also the declining channel). A long-term bullish bias is favoured as long as the key support 99.57 (19/11/2013 low) holds. A break to the upside out of the current consolidation phase between 100.76 (04/02/2014 low) and 103.02 is needed to resume the underlying bullish trend. A major resistance stands at 110.66 (15/08/2008 high).

USD/CHF has broken the supports at 0.8908 (05/06/2014 low, see also the 38.2% retracement) and 0.8883. A break of the hourly resistance at 0.8915 (30/06/2014 high) is needed to negate the short-term bearish trend. A support area now stands between 0.8841 and 0.8831 (61.8% retracement). A key resistance lies at 0.8975. From a longer term perspective, the bullish breakout of the key resistance at 0.8953 suggests the end of the large corrective phase that started in July 2012. The long-term upside potential implied by the double-bottom formation is 0.9207. A key resistance stands at 0.9156 (21/01/2014 high). The persistent weakness has forced us to close the remaining of our long position.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Swiss franc is down for a second straight trading day. In the European session, USD/CHF is trading at 0.8980, up 0.38% on the day. Switzerland’s GDP Eases to 0.2% The Swiss...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.