- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Is Oil's Dividend At Risk?

Oil has experienced one of the most vicious selloffs in history, with WTI crude plunging over 60% since the beginning of the year to its lowest levels in over 2 decades. Now analysts are worried that the price of oil could go negative, and energy companies would be forced to pay customers to take the commodity off their hands.

Oil began to slide when the novel coronavirus took hold of China at the beginning of the year, which spurred the start of the oil price crash with demand concerns being the key catalyst. The virus’s global spread and evolution to a pandemic further escalated energy demand anxiety.

Now Saudi Arabia and Russia are engaging in a price war. Both nations are ramping up production in a battle that is hammering oil companies around the world. The market is flooded with supply and demand is drying up, the perfect storm for an oil price crash.

Is Oil’s Dividend At Risk?

Companies like Chevron (NYSE:CVX) , ExxonMobil (NYSE:XOM) , and British Petroleum (NYSE:BP) has been providing investors with a consistent dividend for close to a century. These companies are now experiencing a massive cash flow issue that could put these long-standing dividends at risk.

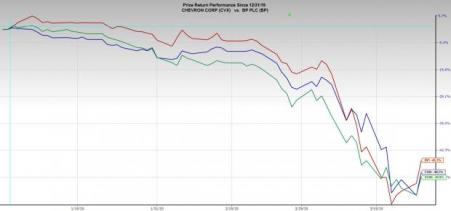

These three stocks have plummeted more than 45% since the beginning of the year as investors worry about the survival of the energy sector. With WTI crude teetering around the low $20s and Brent trading around $30 per barrel, these firms will be losing money until oil demand resumes.

Maintaining dividends is the oil industry’s biggest priority right now, and I believe they will be able to sustain it for at least 2020. The energy sector’s financial positioning was healthy coming into this downturn, and liquidity remains robust.

To maintain current dividend levels, firms are going to be forced to substantially cut costs, including cap-ex and operational expenses, which will put a pause on growth. We can expect that balance sheets will slowly deteriorate until demand can be reestablished.

Financial Positioning

As the price of these stocks plummet, their yields skyrocket. These healthy yields are the only thing attractive about these stocks right now, and the companies do not want to risk losing it. Here is a look at their liquidity.

BP (LON:BP) – 13.5% yield

BP is currently holding $26.8 billion in cash & equivalents combined with a $10 billion line of credit, which gives the firm roughly $37 billion in liquidity. BP is the most liquid of its competitors, with its liquidity more than covering its debts through 2022.

“BP’s cash flow sensitivity to oil price is $340m for $1/bbl,” according to Jefferies Equity Research. BP is the most hedged of its competitors, with crude price changes impacting its cash-flows the least.

Chevron (CVX) – 9.5% yield

Chevron has a $5.75 billion in cash & equivalents combined with a $9.75 billion line of credit, giving the company $15.5 billion in liquidity. CVX’s liquidity covers 80% of its debts through 2022.

“Chevron’s cash flow sensitivity to oil price is $500m for $1/bbl,” according to Jefferies Equity Research.

ExxonMobil (XOM) – 11% yield

Exxon has $3.1 billion in cash & equivalents but issued $8.5 billion in bonds last week, bringing its cash levels up to $11.6 billion. XOM’s liquidity covers roughly 75% of its debts through 2022.

“Exxon’s cash flow sensitivity to oil price is $600m for $1/bbl,” according to Jefferies Equity Research.

Take Away

I would not be rushing to get into oil stocks at this time as a further downslide to oil prices may be on the horizon. The concept of negative oil prices is sending fear down the spine of energy executives around the world.

This oil supply glut will not last forever and suspect that once demand resumes (hopefully later this year), the fear of dividend cuts will be alleviated, and energy stocks will rebound.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Exxon Mobil Corporation (XOM): Free Stock Analysis Report

Chevron Corporation (CVX): Free Stock Analysis Report

BP p.l.c. (BP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.