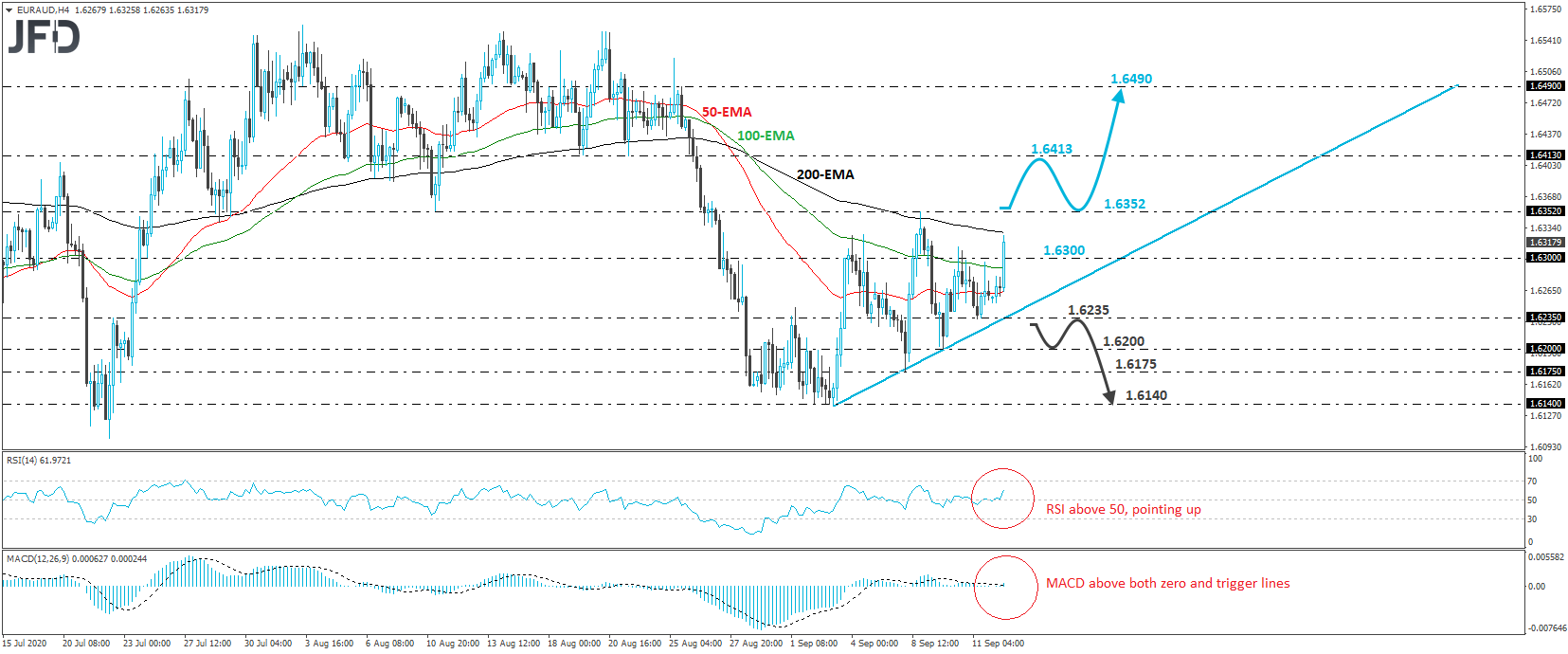

EUR/AUD shot higher during the European morning Monday, breaking above the resistance (now turned into support) territory of 1.6300. Since September 3rd, the rate has been trading above a newly establish upside support line and thus, we would consider the short-term outlook to be positive for now.

However, before we get confident on larger upside extensions, we would like to see a decisive break above last Tuesday’s high, at around 1.6352. Such a move would confirm a forthcoming higher high and may pave the way towards the 1.6413 area, defined as a resistance by the inside swing lows of August 19th and 21st. The bulls may decide to take a break after hitting that zone, thereby allowing the rate to correct somewhat lower. However, as long as it would be trading above the aforementioned upside line, we would see decent chances for another leg north. If, this time, the 1.6413 fails to provide resistance, then we may see the advance extending towards the 1.6490 area, marked by an intraday swing high formed on August 25th.

Turning our attention to the short-term momentum studies, we see that the RSI is above 50, pointing up, while the MACD lies fractionally above both its zero and trigger lines, pointing up as well. Both indicators suggest that EUR/AUD may have started gaining upside speed, supporting the notion for the pair to drift higher in the short run.

That said, in case we see the rate falling below Friday’s low of 1.6235, we will abandon the bullish case and we will start examining lower areas. The rate will also be below the pre-mentioned upside line and may allow the bears to target last Wednesday’s low, at 1.6200, or the low of the day before, at 1.6175. Another break, below 1.6175, could set the stage for the low of September 3rd, at 1.6140.