- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Is Applied Materials (AMAT) The Best Semiconductor Value Stock?

Investors in search of great value opportunities in the semiconductor industry might look no further than Applied Materials (NASDAQ:AMAT) . This Silicon Valley giant is one of the top suppliers of equipment to the global semiconductor business, and with the rise in demand for high-end chips throughout the world, AMAT has seen its client activity pick up significantly.

In its most recent quarter, Applied Materials witnessed adjusted earnings of $1.06 per share, up 59% from the year-ago period. Total quarterly revenues came in at $4.2 billion, improving more than 28% year over year.

It is not often that companies with AMAT’s size and legacy see such rapid expansion. And investors have certainly noticed this growth, sending the stock soaring more than 60% over the past year. Still, there appears to be plenty of room left for Applied to run higher.

One catalyst for a continued surge could be the company’s improving outlook. Within the past 60 days, we have seen seven positive revisions for AMAT’s full-year earnings estimates, bringing our Zacks Consensus Estimate a whopping 31 cents higher over that timeframe. We now expect to see the company witness full-year earnings growth of 35%.

Even with the stock’s recent surge, AMAT’s positive outlook makes its forward-looking guidance extremely attractive for value investors. What’s more, the stock is also trading at a discount to its most comparable peers.

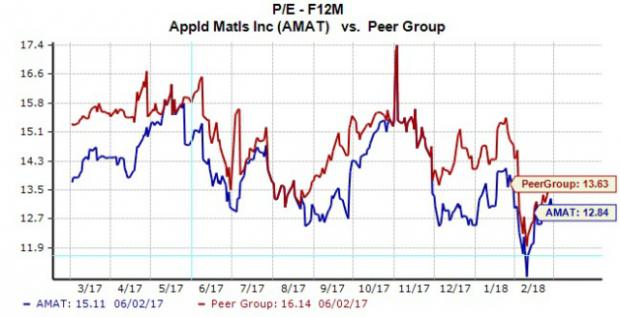

Here’s Applied’s Forward P/E trend compared to that of its peer group:

AMAT’s peer group includes ASML Holding (NASDAQ:ASML) , Lam Research (NASDAQ:LRCX) , KLA-Tencor (NASDAQ:KLAC) , and Advanced Energy Industries (NASDAQ:AEIS) . Not all of these companies are direct competitors to AMAT, but they do function as suppliers to semiconductor manufacturers. Comparing AMAT to these stocks helps us show how investors tend to value this niche market.

When we break it down like this, we can really see that AMAT is an interesting value option. However, we should note that the stock is only sporting a “C” grade for Value in our Style Scores system. In contrast to its attractive P/E, AMAT’s P/S of 3.9 is less appealing than the broader market. Applied might also raise eyebrows from a cash-flow perspective, as it is only generating about $3.69 in cash per share right now—about 40% less than its industry’s average.

Still, the foundation of AMAT’s is only getting stronger right now, and the stock’s Forward P/E implies that investors are getting a great price for that strength.

Want more market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks’ has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

KLA-Tencor Corporation (KLAC): Free Stock Analysis Report

ASML Holding N.V. (ASML): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Advanced Energy Industries, Inc. (AEIS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.