- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Inogen Rides On Solid Product Portfolio Amid Forex Woes

On Dec 11, we issued an updated research report on leading medical devices company Inogen Inc. (NASDAQ:INGN) . The stock carries a Zacks Rank #3 (Hold).

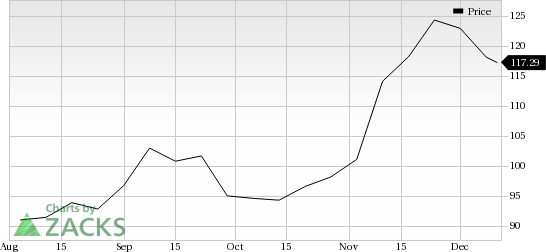

Inogen's price movement over the past six months has been favourable. The company represented a return of almost 33.4%, better than the industry's rally of 5.2%. The current level is also higher than the S&P 500’s return of 9.3% over the same time frame.

Inogen’s expanding product portfolio is a key catalyst. The company provides oxygen-concentrator solutions for portable and stationary use. Inogen’s flagship product — One G4 — is a single-solution portable oxygen concentrator (POC).

Further, Inogen One G3 POC provides mobility and independence to oxygen therapy users. This platform is the lightest continuous flow oxygen concentrator in the market and consumes less power than competitive devices.

Solid business-to-business sales performance is another reason for the stock's solid performance. Notably, Inogen has a market cap of $2.47 billion. The company’s direct-to-customer business model has lent it a leading position in the oxygen therapy market. The direct-to-consumer model provides companies an opportunity to build a unique brand relationship directly with customers. In an effort to drive growth in the direct-to-consumer business, the company announced that it has secured an additional facility in Cleveland, OH.

Inogen, Inc Price

On the flip side, foreign exchange headwinds are a concern. Inogen generates a significant portion of revenues from the International market. Management expects international revenues to be lumpy, thanks to the timing and size of the distributor. Adverse foreign currency exchange rates are likely to impede revenue growth in the near term due to the strengthening of the U.S. dollar against the Euro and other foreign currencies.

In the Long-term Oxygen Therapy (LTOT) market, POC adoption continues to witness significant challenges. This is primarily due to the lack of awareness among consumers about the benefits of POC devices, higher upfront cost compared with traditional delivery model and reluctance of home equipment medical providers to support POC adoption.

We believe that lack of awareness ensures higher cost related to sales & marketing that can mar profits. We believe that these headwinds related to POC adoption are major concerns that can hurt Inogen’s prospects in the long haul.

Key Picks

A few better-ranked medical stocks are athenahealth, Inc. (NASDAQ:ATHN) , Align Technology, Inc. (NASDAQ:ALGN) and Myriad Genetics, Inc. (NASDAQ:MYGN) .

Notably, athenahealth, Align Technology and Myriad Genetics sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

athenahealth has a long-term expected earnings growth rate of 22.3%.

Align Technology has a long-term expected earnings growth rate of 28.9%.

Myriad Genetics has a long-term expected earnings growth rate of 15%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

athenahealth, Inc. (ATHN): Free Stock Analysis Report

Inogen, Inc (INGN): Free Stock Analysis Report

Myriad Genetics, Inc. (MYGN): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.