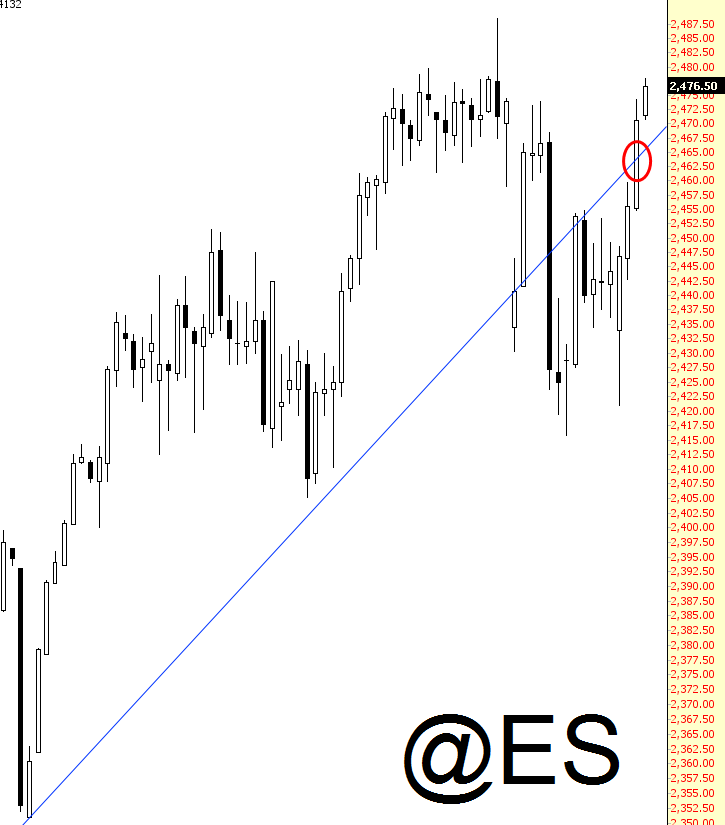

The monthly jobs report came out and although it was a little soft, equity reaction was initially fairly positive. It’s tough to say where these things wind up at the end of the day, because ultimate daily direction has little correspondence to the initial knee-jerk. As I write, the ES is up 6, having pushed cleanly above its broken trendline yesterday, circled in red (so much for THAT reversal).

Gold initially had a nice double-digit pop, but is up only five dollars. Clearly the forex markets are still digesting this jobs news and figuring out what it means for the dollar (and thus gold). All the same, the medium-term picture is still quite positive for gold.

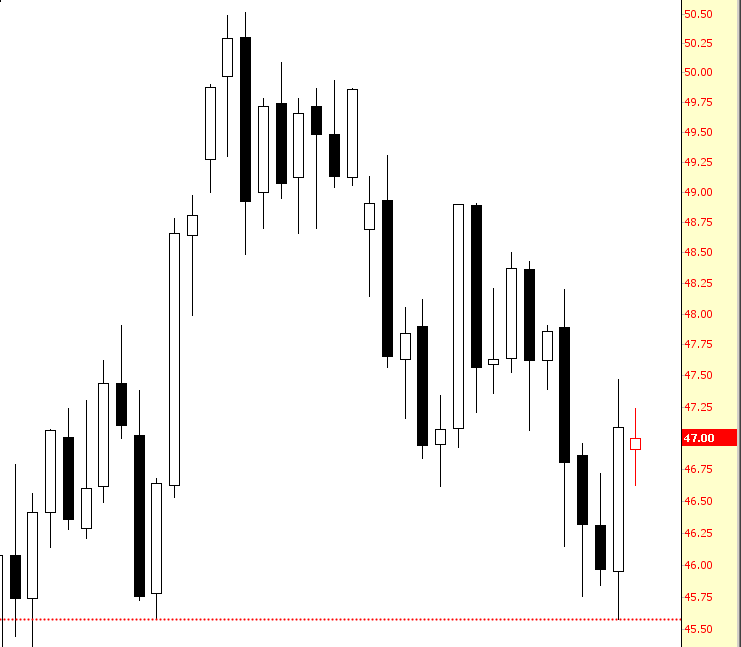

Crude oil’s downtrend is still cleanly in place, although we need to bust that support at 45.50 to get the next bearish boost.

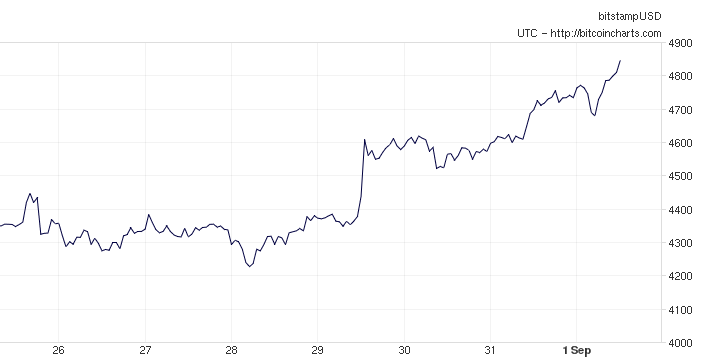

Of course, we’re all completely wasting our time with such tiny, jerky moves, since the true way to riches keeps proving itself — bitcoin seems destined to cross $5,000 very soon (remember what a huge deal it was when it crossed above ONE thousand dollars?)