- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Ingles Markets (IMKTA): The Perfect Mix Of Value And Rising Earnings Estimates?

Value investing is always a very popular strategy, and for good reason. After all, who doesn’t want to find stocks that have low PEs, solid outlooks, and decent dividends?

Fortunately for investors looking for this combination, we have identified a strong candidate which may be an impressive value; Ingles Markets, Incorporated (NASDAQ:IMKTA) .

Ingles Markets in Focus

IMKTA may be an interesting play thanks to its forward PE of 11.6, its P/S ratio of 0.2, and its decent dividend yield of 2%. These factors suggest that Ingles Markets is a pretty good value pick, as investors have to pay a relatively low level for each dollar of earnings, and that IMKTA has decent revenue metrics to back up its earnings.

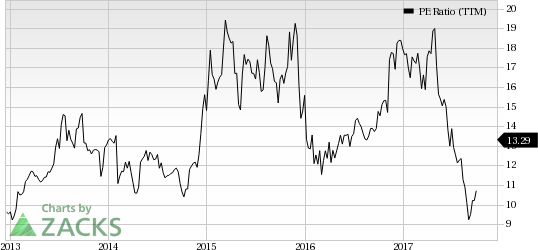

Ingles Markets, Incorporated PE Ratio (TTM)

But before you think that Ingles Markets is just a pure value play, it is important to note that it has been seeing solid activity on the earnings estimate front as well. For current year earnings, the consensus has gone up by 16.3% in the past 30 days, thanks to one upward revisions in the past one month compared to none lower.

This estimate strength is actually enough to push IMKTA to a Zacks Rank #1 (Strong Buy), suggesting it is poised to outperform. You can see the complete list of today’s Zacks #1 Rank stocks here.

So really, Ingles Markets is looking great from a number of angles thanks to its PE below 20, a P/S ratio below one, and a strong Zacks Rank, meaning that this company could be a great choice for value investors at this time.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Ingles Markets, Incorporated (IMKTA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.