- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Infosys Selected By Allison Transmission To Offer IT Services

Infosys Limited (NYSE:INFY) recently announced that Allison Transmission Holdings, Inc. (NYSE:ALSN) has selected the company to provide information technology (IT) infrastructure management services. The world’s biggest manufacturing company of fully automatic transmissions for medium- and heavy-duty commercial vehicles, Allison Transmission, will leverage Infosys’ proprietary artificial intelligence platform, Nia, which would enable the former to meet increasing global technology requirements.

Notably, Nia will assist the company to install a new software command center for Allison Transmission. This will lead to superior management of technology processes and physical assets, thus enabling Allison Transmission to achieve agility and efficiency.

Existing Business Scenario

Over the past few quarters, Infosys had collaborated with many biggies for fortifying its portfolio and market share. In fact, Nia, the company’s integrated AI platform, is helping to accelerate the pace of technology adoption. Currently, Nia has over more than 200 engagements across 100 clients.

Also, as of now, cyber security is proving to be one of the company’s prominent profit churners. Further, robust performance by the data analytics, testing and enterprise system segments signals at the bright prospects ahead.

Meanwhile, the company has been witnessing robust momentum in software and services business under the “New” initiative. Also, the company continues to renew traditional services and rolled out others in areas such as Cloud Ecosystem, Big Data and Analytics, which in turn is boosting its top-line performance.

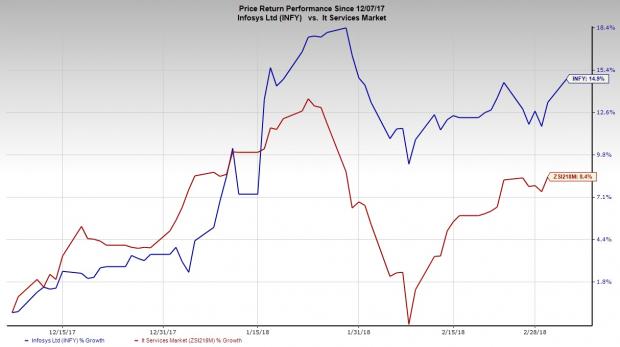

This apart, the company has been strengthening core competencies by pursuing strategic collaborations and acquisitions. Notably, the Zacks Rank #3 (Hold) stock has rallied 14.9% in the past three months, outperforming the industry’s gain of 8.4%.

Despite these positives, rapid proliferation of customizable internet-based software has been hampering Infosys’ traditional outsourcing business. Most clients now prefer to seek service delivery through digital technology, thus adding to the company’s woes. Moreover, management believes that economic conditions in many of its markets remain quite challenging that might weigh on the company’s profitability, going ahead.

Key Picks

Some better-ranked stocks from the same space are Badger Meter, Inc. (NYSE:BMI) and Adobe Systems Inc. (NASDAQ:ADBE) . While Badger Meter sports a Zacks Rank #1 (Strong Buy), Adobe Systems carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Badger Meter has surpassed estimates thrice in the trailing four quarters, with an average positive earnings surprise of 1%.

Adobe Systems has outpaced estimates in the preceding four quarters, with an average earnings surprise of 9%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Infosys Limited (INFY): Free Stock Analysis Report

Adobe Systems Incorporated (ADBE): Free Stock Analysis Report

Badger Meter, Inc. (BMI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Nvidia’s muted reaction keeps tech on edge, with chipmakers in focus. Nasdaq’s 20980-21000 support holds—for now. A break could mean trouble. With Nvidia done, GDP today and...

Here’s where I see stocks now: Yes, we’ve got some legitimate concerns as some economic warning signs appear—and run up against the tech-driven optimism that’s powered stocks to...

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.