Since the start of the Fed’s QE3 in September 2012, the decline in US inflation has been three times the rate of decline in US unemployment rate.

It is time markets focused on the proportion of both variables as the Fed’s dual forward guidance is thoroughly put across by the Federal Reserve.

As both inflation and unemployment race to the bottom, understanding the magnitude of both variables and their impact on economic growth becomes vital in assessing clues on Fed policy for 2014, particularly when comparing it to BoE. We repetitively said since September that low inflation figures will be the next trick for the dovish FOMC members to maintain their taperless and low rate credentials over monetary policy.

Inflation Decline since Start of QE3

Since the start of QE3 in September 2012, US inflation (as measured by the Fed’s preferred measure of core PCE price index), has fallen 35% from 1.7% to 1.1% (the lowest since March 2011). Meanwhile, the CPI measure fell by about 40%–from 2.0% y/y in Sep 2012 to 1.2% in November.

With US unemployment rate falling by 11% since September 2012 and inflation falling by three times as much, the Fed’s priority in supressing bond yields will be best grasped via comparing the trends in unemployment relative to inflation to inflation.

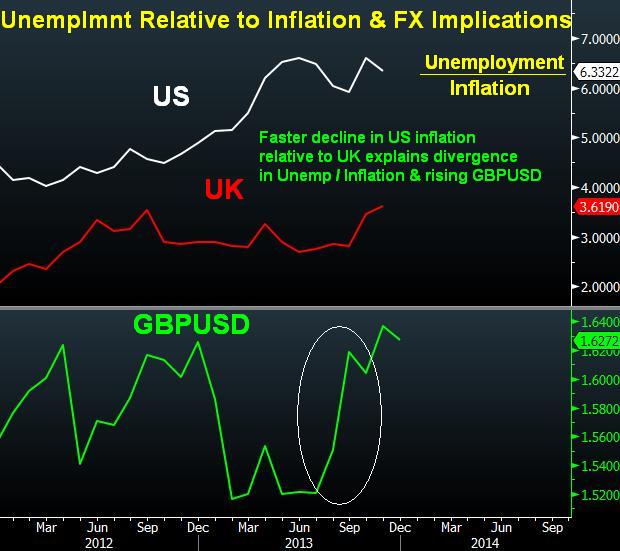

Unemployment Divided by Inflation: US vs. UK

Today’s release of 2.1% y/y CPI in the UK is the lowest inflation level in four years. But UK unemployment is also at 4-year lows at 7.6%. For currency traders evaluating the forex impact on GBP and USD from declining inflation and unemployment in the UK and US, one of the suggested methods of comparative analysis for both central banks is via unemployment relative to inflation.

The charts below compare unemployment/ inflation divisors for the US and UK, illustrate that a lower unemployment/inflation divisors (U/I) for the UK at 3.6% (7.6% / 2.1%), versus 6.3% for the US (7.0% / 1.1%).

In comparing the absolute value of both nations’ unemployment/inflation divisors (U/I), the consistently lower value for the UK’s U/I reflects the historically higher UK inflation (aka faster declining US inflation), particularly since September 2012, thereby suggesting more “hawkish premium” for GBP over USD.

In comparing the trend/divergence of both nations’ unemployment/inflation divisors, the rising trend of US unemployment/inflation away from that of the UK also reflects the continuous dovishness of the Fed relative to the BoE.

Despite the fact that US unemployment of 7.0% is lower than the UK’s 7.6%, the U/I is higher for the US, highlighting the accelerating decline in US inflation. If the divergence continues, then favouring GBP over USD in 2014 on the basis of Fed/BoE opens the door for $1.6700 in GBPUSD in late Q1 2014, when an eventual tapering of the Fed would be likely offset by slashing interest on reserves.

Disclosure: FX Solutions assumes no responsibility for errors, inaccuracies or omissions in these materials. FX Solutions does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FX Solutions shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials.

The products offered by FX Solutions are leveraged products which carry a high level of risk to your capital with the possibility of losing more than your initial investment and may not be suitable for all investors. Ensure you fully understand the risks involved and seek independent advice if necessary.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Inflation Vs. Unemployment And FX Implications For The UK And U.S.

Published 12/18/2013, 12:49 AM

Updated 01/01/2017, 02:20 AM

Inflation Vs. Unemployment And FX Implications For The UK And U.S.

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.