- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

TripAdvisor Plunges To 52-Week Low: What's Pushing It Down?

Shares of TripAdvisor, Inc. (NASDAQ:TRIP) hit a 52-week low of $36.10 on Jun 19.

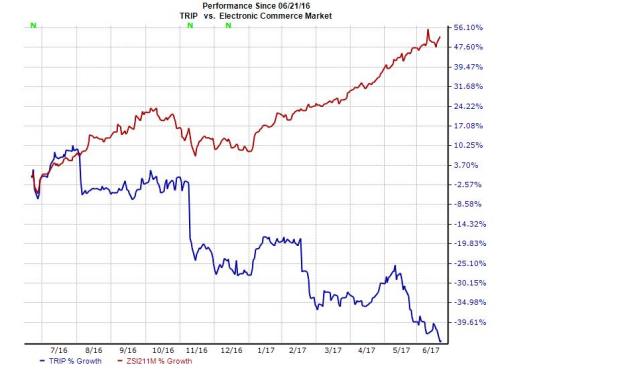

The stock has declined 23.1% since its first-quarter 2017 results on May 9 against the Zacks Electronic Commerce industry’s gain of 4.6%. Shares have lost a massive 43.8% over the last year in contrast to the industry’s gain of 52.3%.

Currently, TripAdvisor faces quite a few challenges. Let’s check out the factors that have resulted in the new low.

Credit Suisse (SIX:CSGN) Downgrade

Credit Suisse on Monday downgraded the company from “neutral” to “downgrade” slashing its price target from $40 to $34. The firm anticipates a 10% decline in TripAdvisor’s EBITDA and a challenging third quarter based on higher 2018 television advertisement forecast.

Credit Suisse analysts pointed out TripAdvisor’s higher valuation compared with its online travel industry peers such as Priceline (NASDAQ:PCLN) and Expedia (NASDAQ:EXPE) despite disappointing earnings, weak growth and slow turnaround.

Disappointing Earnings

The company missed the Zacks Consensus Estimate on earnings and revenues in the first quarter. Revenue headwinds that originated from the 2016 instant booking roll out continue to impact the company’s profitability.

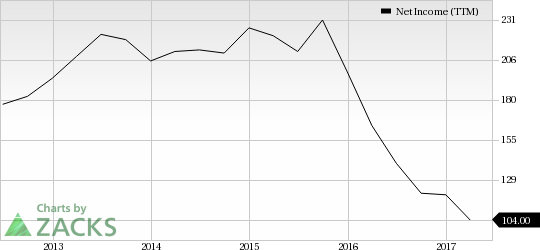

TripAdvisor, Inc. Net Income (TTM)

Rapid growth in mobile traffic has led to lower monetization benefits and huge investments and continue to impact TripAdvisor’s financial results. Macro headwinds, increasing competition from Priceline, Expedia and Alphabet (NASDAQ:GOOGL) and lack of visibility also remain overhangs.

The modest 5.7% year-over-year growth in revenues indicates a slow pace of transition from travel review to travel bookings. Last month, CFO Ernst Teunissen anticipated a decrease in click-based and transaction revenues that forms a major part of the company's revenues. He expects it to fall to mid- to high-single digits in the current quarter after coming in at 12% in the first quarter. These factors have been adversely impacting the company’s share price.

Downward Estimate Revisions

For the full year, five estimates have moved down in the past 60 days, compared with two upward revisions. This has caused the consensus estimate to trend lower, going from earnings of 81 cents a share 60 days ago to its current level of a loss of 78 cents.

Also, for the current quarter, TripAdvisor has seen six downward estimate revisions versus no upward revision, which dragged the consensus estimate down to 20 cents a share from 23 cents over the past 60 days.

To Conclude

Notwithstanding the challenges, the company has been making considerable progress with growth initiatives to boost hotel bookings, strong focus on developing mobile products, expansion into the international restaurant reservation space and improvement in user growth and engagement, especially related to mobile devices.

The company could turn the wheel in its favor by accelerating the pace of its transition.

Currently, TripAdvisor is a Zacks Rank #3 (Hold) stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Expedia, Inc. (EXPE): Free Stock Analysis Report

The Priceline Group Inc. (PCLN): Free Stock Analysis Report

TripAdvisor, Inc. (TRIP): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.