- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why Sony (SNE) Is A Strong Value Stock

Value stocks might not be in vogue these days—especially as stocks like Tesla (NASDAQ:TSLA) skyrocket—but nevertheless, investors in search of stability and sound fundamentals might look no further than tech giant Sony (NYSE:SNE) as a strong value play.

At a time when growth stocks and companies such as Amazon (NASDAQ:AMZN) are trading at 270x earnings, Sony presents investors who long for low valuation metrics with a great option. Sony sports an “A” grade for Value in our Style Scores system, and maybe more importantly, it is also currently a Zacks Rank #1 (Strong Buy).

This Japanese electronics power is a household name, with a diverse business portfolio that includes everything from televisions to video games to semiconductors. On top of that, Sony is part of an industry that currently ranks in the top 8% of the 265 different industries tracked by Zacks.

Now that we have some of the basics about Sony down, let’s dive deeper into some of the company’s valuation fundamentals to show value investors what the company has to offer.

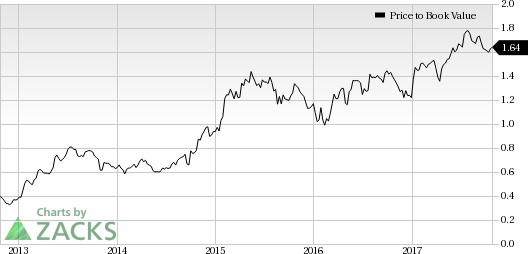

Sony’s “A” grade for Value in our Style Scores system is backed up by its 0.67 P/S ratio, which marks a major discount compared to other companies in its industry. The company’s P/B ratio of 1.64 also represents a discount against the “Audio Video Production” average.

What’s more, Sony is currently trading at just 15.98x earnings, which marks a discount to competitors such as Panasonic (OTC:PCRFY) , as well as the S&P 500 average.

Along with these traditional valuation metrics, Sony’s 2.93 cash flow per share ratio tops the “Audio Video Production” industry’s negative rate. And as a little side note, Sony crushed earnings estimates in both of its last two quarters, and its shares have surged over 32% this year.

It seems clear that Sony represents strong value for investors. When paired with its current Zacks Rank #1 (Strong Buy) and its overall “A” VGM grade, Sony could be a stock that investors on the hunt for value might want to consider.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but chosen members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting today, and for the next month, you can follow all Zacks’ private buys and sells in real time. Our experts cover all kinds of trades: value, momentum, ETFs, stocks under $10, stocks that corporate insiders are buying up, and companies that are about to report positive earnings surprises. You can even look inside portfolios so exclusive that they are normally closed to new investors. Click here for Zacks' secret trades>>

Sony Corp Ord (SNE): Free Stock Analysis Report

Panasonic Corp. (PCRFY): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Tesla Inc. (TSLA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.