Through a mixture of winning new outsourced logistics contracts, exposure to the substantially higher-growth e-commerce subsector and solid underlying market growth, we forecast that Eddie Stobart Logistics PLC (LON:ESLE) will grow EBIT at 15.3% CAGR over the next three years. Since being taken private in 2014, ESL has brought in new management and grown earnings significantly. Listing on AIM in April 2017 enabled the company to pay down debt, make a small acquisition and set the business up for the next phase of expansion. Despite its sector-leading operations and outlook, ESL trades at a discount to its global peers. We believe it should trade at least in line and our fundamentals-based valuation per share of 200p offers equity holders upside of 26%.

Growing e-commerce and profitability drive returns

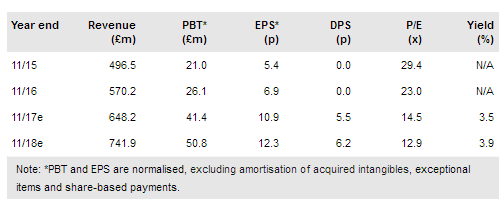

ESL’s scale, technology and network drive operating margins ahead of its closest listed UK and European peers. Operating profit growth will be driven by the top line, however, with a mixture of market growth, the contribution of substantially higher growth from e-commerce, plus, most significantly, winning new outsourced logistics contracts all combining to drive 13.6% three-year underlying revenue growth. ESL’s superior operations will, we believe, facilitate a 3.5% dividend yield starting this year, which is an attractive differentiator in a sector that yields 1.1%.

To read the entire report Please click on the pdf File Below