- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

HSBC's Prosecution Agreement Expires, DoJ To Dismiss Charges

HSBC Holdings Plc (LON:HSBA) (NYSE:HSBC) is set to put behind the money laundering fraud it was involved in five years ago and is committed to improve security and compliance systems. The Department of Justice (DoJ) has agreed to file a motion with the U.S. District Court to dismiss the charges under the now expired Deferred Prosecution Agreement (DPA).

Background

In 2012, HSBC was fined a massive penalty of $1.9 billion for its involvement in helping the drug cartels launder money in Mexico and handling transactions for countries under U.S. sanctions, such as Iran, Libya and Sudan.

Also, the bank was made to sign a DPA, under which it promised to strengthen anti-laundering practices. Per the agreement, if the bank had faltered again, it would have been sued by the authorities.

HSBC was spared the horror of having a criminal record in the United States, which would have significantly hampered its operations in the country and adversely impacted financials.

HSBC had taken several steps to come out clean from the probation period. It invested quite a lot in the technologies required for regular monitoring of transactions. It also installed a special financial crime risk unit which looks over all areas of financial crime risk management.

Current Scenario

Shares of HSBC Holdings were up 1.7% yesterday, reflecting investors’ optimism on the expiration of the agreement.

In July 2013, an independent compliance monitor was appointed to annually review whether the bank is adhering to the requirements of the DPA. Also, he has been serving as HSBC’s Skilled Person under a 2012 Direction issued by the U.K. Financial Conduct Authority and is expected to continue with his role for a period of time at the authority’s discretion.

Further, the bank remains committed to continuing with the progress it has made in anti-money laundering practices.

Stuart Gulliver, CEO of HSBC Holdings said, “We are committed to doing our part to protect the integrity of the global financial system, and further improvements to our own capability and contributions toward the partnerships we have established with governments in this area.”

Our Take

The bank would now be able to put behind the case and look forward to developing its business. Also, it would be able to distribute excess capital to its shareholders, thus enhancing their value.

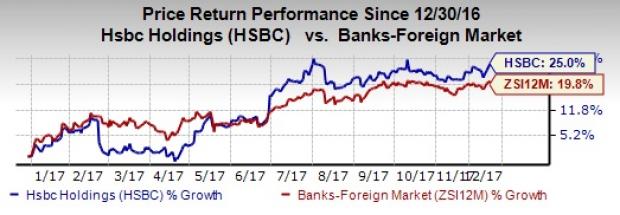

Shares of HSBC Holdings have gained 25% year to date, outperforming the 19.8% growth of the industry it belongs to.

Currently, the stock carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some foreign banks worth considering are Bank of N.T. Butterfield & Son Limited (NYSE:NTB) , Credicorp Ltd (NYSE:BAP) and ING Group (NYSE:ING) . All these stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Bank of N.T. Butterfield & Son’s Zacks Consensus Estimate for current-year earnings has been revised 2.2% upward in the last 60 days. The company’s share price has risen almost 21% year to date.

Credicorp’s current-year earnings estimates have been revised nearly 1% upward over the last 60 days. Also, its shares have gained 32.3% so far this year.

ING Group’s Zacks Consensus Estimate for current-year earnings has moved 1.3% up over the last 60 days. Its share price has rallied 31.3% year to date.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Credicorp Ltd. (BAP): Free Stock Analysis Report

HSBC Holdings PLC (HSBC): Free Stock Analysis Report

Bank of N.T. Butterfield & Son Limited (The) (NTB): Free Stock Analysis Report

ING Group, N.V. (ING): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.