Under Armour Inc C (NYSE:UA) is from Baltimore and so am I. They’re hometown heroes and I like when they do well. Everybody in town has an opinion about our local sportswear giant, and the internet is wrapped up in the buzz as well. But not many people have good things to say.

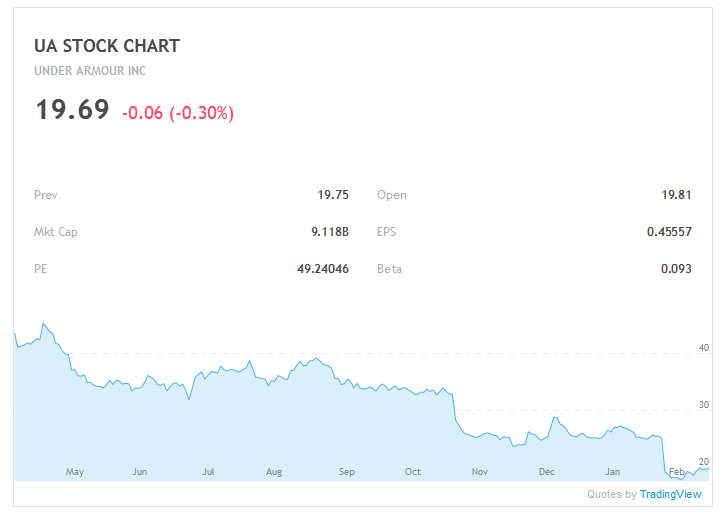

If you’re invested in $UA, the past year has been a nauseating slide into oblivion. This time last year, UA stock was selling for $83/share. The same share has lost more than 75% of its value since then.

The problems are myriad and investors are fleeing, but new investors are wondering if these prices indicate that now could be a good time to invest in $UA for the very first time.

The question is: Will Under Armour rally and grow into the international giant their investors dream of, or is this the beginning of the end?

A Deeper Look at Under Armour

Kevin Plank founded Under Armour 21 years ago. The company introduced its first footwear line ten years later. The company bounded into household name status on the basis of their workout clothes, magical “moisture wicking” materials, shoes, and home-grown underdog status.

UA’s star was on the rise, but many problems have arisen in the past year which have severely damaged its forward momentum. In recent months, we’ve seen the CFO resign “for personal reasons”. We’ve seen Plank learn that kissing the Trump ring results in significant boycotts. We’ve seen domestic retail sales become increasingly tenuous. We’ve seen a flood of excess UA stock in discount bins around the country. Even the Steph Curry shoe was a dud.

Under Armour needs a drastic change of course.

So what’s going well for Under Armour? Despite the signs that Americans are souring to the brand (a potential death knell for apparel and other commodities), UA is dramatically expanding sales overseas. International revenue increased 55% and footwear increased 36% last year.

But these revenue numbers don’t overcome the fact that UA has operated with negative cash flow two years in a row. The company currently has a 43.85 P/E ratio, which does nothing to console current shareholders. Consumer tastes are fickle, and they’re currently trending away from UA.

Is Now the Time to Buy $UA?

Not for me.

Under Armour’s domestic business is a mess. Trying to recover from the effects of excess stock flooding the market, UA wants to refocus as a high-end apparel brand. But if the brand just isn’t cool anymore, why would the consumer pay more a premium for their clothes?

So it is with apparel and commodities. With multiple businesses selling essentially the same product, cool means everything. UA doesn’t have the long history to view boycotts as simply a bump in the road, not like a Starbucks (NASDAQ:SBUX) anyway. This latest foible may be recoverable, but I’m not sure we’ve seen the bottom of this stock drop yet. If we hit single digits, I might bite, but what kind of a future would Under Armour have at that point?