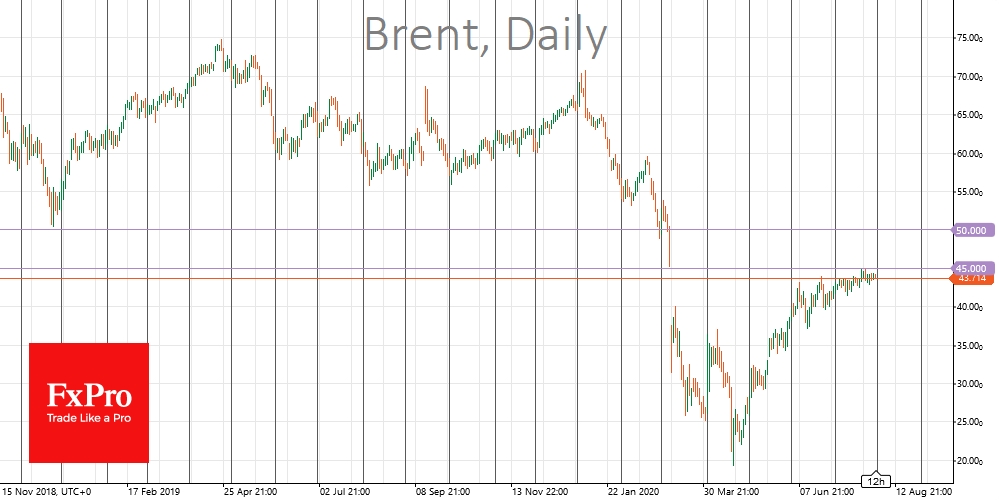

The price of crude oil keeps slipping, despite the recent weakening of the dollar. This is an unusual situation, and it seems like bad news for oil. Currently ignoring the positive attitude, Brent and WTI may receive a powerful blow if the markets return to a wary mood.

Often, oil grows several times stronger than the weakening of the US currency. For example, from 2000 to 2008, the dollar index lost 30%, while the price of Brent grew 5.5 times.

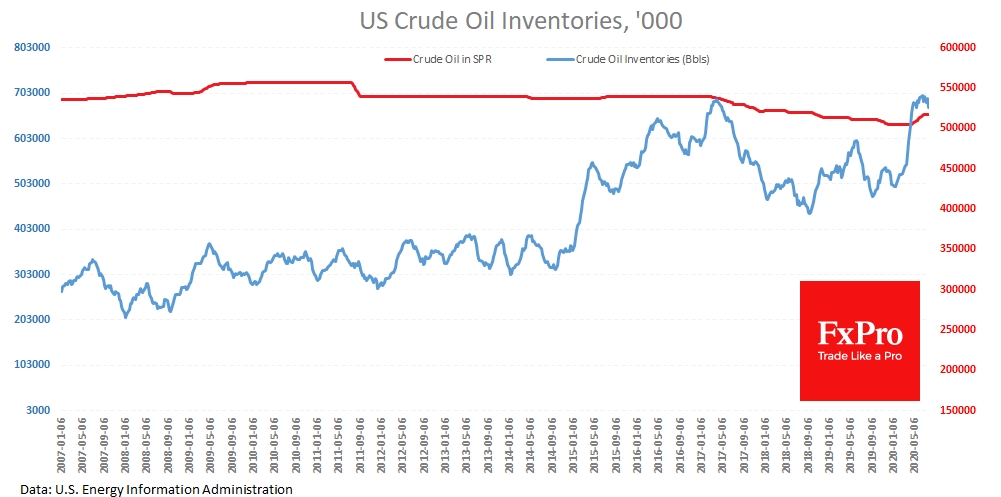

Now, oil cannot be called oversold, as it seemed to be March-May. Vast petroleum reserves accumulated during the lockdown in many countries, hindering its growth. Although the rate of reserves creation is no longer so frightening, their amounts are still putting pressure on prices.

The latest weekly data showed a decline in crude oil reserves in the USA by 10.6M barrels. However, the decline in reserves is the norm for this time of the year. Crude oil in private stocks is 20.5% higher than a year ago (+20.6% a week earlier).

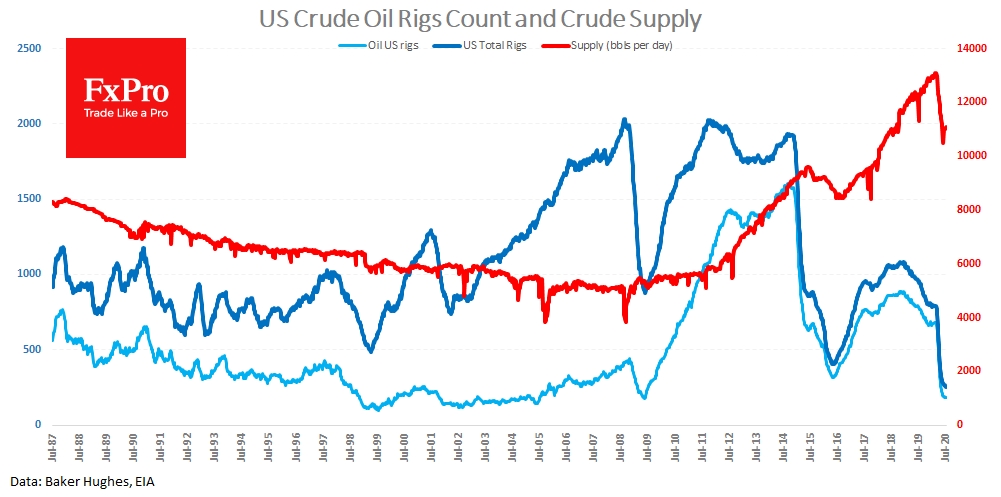

The total number of drilling rigs in operation has been decreasing weekly since March. However, last week, the data showed the first increase in the number of oil rigs. This may be the first signal that U.S. production companies have faith in the demand for their oil and believe the current or forecast prices are sufficient to return to production growth.

U.S. Crude supply is about the same as a year ago, at 11.1M barrels per day. In countries adhering to the OPEC+ agreement, production is more than 10% below last years levels, while Saudi Arabia and Russia temporarily cut their output by more than 20% from the peaks of March.

However, they are set to bring capacity back into operation as demand gradually recovers. On the one hand, quotes will be pressed by the vital need for OPEC+ countries to restore production as quickly as possible to raise budget revenues. As of next week, the cartel and allies will increase production quotas.

An additional unknown is the dynamics of consumption, which is affected by threats of new restrictions on movement due to the increasing number of new coronavirus victims. This further aggravates the prospects for recovery in the industry and risks turning into a new round of price reductions in the coming days or weeks.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oil Prices Stymied By High Reserves, Growing Production

Published 07/30/2020, 06:16 AM

Updated 03/21/2024, 07:45 AM

Oil Prices Stymied By High Reserves, Growing Production

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.