- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why Teleflex Has Been Losing Ground Since Q4 Earnings

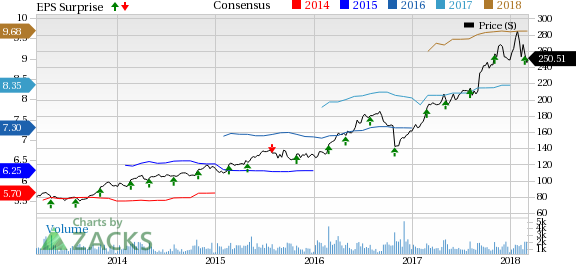

Teleflex Incorporated’s (NYSE:TFX) shares lost 7.6% to close at $250.51 after it announced earnings results on Mar 5. The company reported adjusted earnings per share of $2.44 in fourth-quarter 2017, beating the Zacks Consensus Estimate of $2.40. Earnings improved 14.6% from the year-ago figure of $2.13.

Revenues in Detail

Adjusted revenues in the fourth quarter increased 15.8% year over year to $595.1 million (12.6% at constant exchange rate or CER) but missed the Zacks Consensus Estimate of $602 million owing to some temporary softness.

On a segmental basis, Vascular North America revenues increased 0.5% (0.3% at CER) year over year in the fourth quarter to $80.7 million.

Interventional North America revenues increased 177.6% in the fourth quarter from the year-ago quarter (177.2% at CER) to $61.7 million.

Anesthesia North America revenues were down 9.2% from the year-ago quarter (down 9.4% at CER) to $49.9 million.

Surgical North America revenues in the fourth quarter were down 9.4% from the year-ago quarter (9.8% at CER) to $43.7 million.

EMEA revenues increased 5.8% from the year-ago quarter but fell 2% at CER to $143.6 million. Asia revenues rose 8% in the quarter from the year-ago quarter (4.5% at CER) to $78.8 million. OEM revenues climbed 1.3% from the year-ago quarter but declined 0.1% at CER to $46 million.

All other revenues increased 67% (67.6% at CER) to $90.7 million in the quarter under review.

Operational Update

Teleflex's gross profit during the reported quarter increased 21.1% year-over-year to $330.7 million. Gross margin expanded 245 basis points (bps) to 55.6%.

SG&A expenses in the fourth quarter rose 47.9% year over year to $213.3 million. Research and development expenses rose 62.4% year over year to $25.5 million. Operating expenses totaled $238.8 million in the fourth quarter, up 49.3% year over year.

Adjusted operating margin in the quarter was 15.5%, down 657 bps from the year-ago quarter.

Financial Update

Teleflex exited 2017 with cash and cash equivalents of $333.6 million, compared with $543.8 million at the end of 2016.

2017 at a Glance

Full-year adjusted earnings came in at $8.40 compared with the year-ago figure of $7.34, reflecting an increase of 14.4%.

Full-year adjusted revenues came in at $2146.3 million, up 14.9% from the year-ago period.

2018 Guidance

For 2018, Teleflex expects adjusted revenues growth at CER in the band of 12-13%. The company also expects adjusted earnings per share in the band of $9.55-$9.75. The Zacks Consensus Estimate for full-year earnings per share is pegged at $9.68, within the company’s guided range. The Zacks Consensus Estimate for full-year revenues stands at $2.46 billion.

Our Take

Teleflex exitedfourth-quarter 2017 on a mixed note. We are encouraged to note that the company is working on product innovation through R&D. However, the contraction in operating margin is discouraging. Also, a tough competitive landscape acts as a dampener.

Zacks Rank & Key Picks

Teleflex has a Zacks Rank #3 (Hold).

A few better-ranked stocks that reported solid results this earnings season are PetMed Express (NASDAQ:PETS) , PerkinElmer (NYSE:PKI) and ResMed (NYSE:RMD) . While PetMed sports a Zacks Rank #1 (Strong Buy), PerkinElmer and ResMed carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed reported third-quarter fiscal 2018 results. Adjusted earnings per share were 44 cents, up 88.3% from the prior-year quarter. Revenues rose 13.7% on a year-over-year basis to $60.1 million.

PerkinElmer reported fourth-quarter 2017 adjusted earnings per share of 97 cents. Adjusted revenues were approximately $641.6 million, up from $567 million in the year-ago quarter.

ResMed posted second-quarter fiscal 2018 adjusted earnings per share of $1, up 36.9% from the prior-year quarter. Revenues in the reported quarter increased 13.4% year over year (up 11% at constant exchange rate or CER) to $601.3 million.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Teleflex Incorporated (TFX): Free Stock Analysis Report

PerkinElmer, Inc. (PKI): Free Stock Analysis Report

ResMed Inc. (RMD): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

There was not much positivity to yesterday, even though the supports for key indexes managed to hold. The Russell 2000 (IWM) showed this best with the undercut of the 200-day MA,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.