Ratings of Fifth Third Bancorp (NASDAQ:FITB) and its subsidiaries have been affirmed by Moody’s Investors Service, a rating arm of Moody’s Corporation (NYSE:MCO) . The parent company’s senior debt rating has been affirmed at Baa1. The long-term deposit rating of Fifth Third Bank, a subsidiary of the Fifth Third Bancorp, has been affirmed at Aa3/Prime-1, its senior debt rating at A3 and the subordinated debt rating at Baa1. Further, counterparty risk assessment is A2(cr)/P-1(cr), while the standalone baseline credit assessment (BCA) is a3.

The rating firm’s outlook for the bank remains “stable”.

Rationale Behind the Affirmation

The rating affirmation follows Fifth Third’s strong foothold in the Midwest with diversified revenue sources generating decent profits along with solid deposit levels. An improved asset quality, strong capital levels and liquidity are other driving factors.

Per Moody’s, a strong credit quality of Fifth Third is reflected as the bank’s loan ratio including accruing 90-day past due as well as the restructured loans stand at 2% as of Mar 31, 2017, down from 3.3% back in 2014.

On the capital front, capital ratios have seen an uptrend on strong earnings as well as the bank’s repositioning efforts. Per Moody’s, the adjusted TCE/risk-weighted asset ratio came in at 10.7% as of Mar 31, 2017, up from 9.7% as of 2015. The rating agency’s assessment shows Fifth Third’s strength in withstanding a considerable asset quality and an earnings stress under a severely adverse case scenario.

Despite a challenging revenue growth scenario due to prolonged low interest environment and the bank’s ongoing restructuring efforts, Fifth Third emerged triumphant owing to recorded strong profits on low credit as well as operating costs, along with an upsurge in fee income. The recent interest rate hikes are also expected to bring in some stability to the top line.

Lastly, Moody’s believes the concerned bank’s strong loans and deposit balances support its growth profile.

Per Moody’s, Fifth Third’s standalone BCA (baseline credit assessment) is well-positioned at the a3 US median bank BCA. Additionally, there can be a change in this stable outlook depending on its creditworthiness over the next two years.

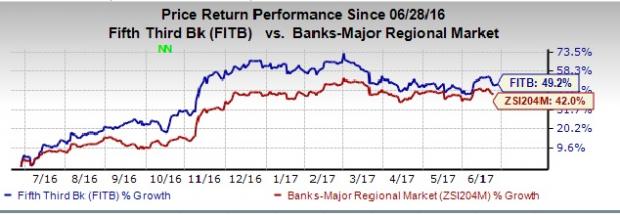

Fifth Third currently carries a Zacks Rank #3 (Hold). The company has recorded a rally of 49.2% over the past one year, thereby outperforming 42% gain for the Zacks categorized Banks-Major Regional industry.

Stocks to Consider

Comerica Incorporated (NYSE:CMA) has been witnessing upward estimate revisions for the last 30 days. Additionally, the stock has jumped over 82% over the past one year. It currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

M&T Bank Corporation (NYSE:MTB) has been witnessing upward estimate revisions for the last 30 days. Over the past one year, the company’s share price has climbed nearly 42.4%. It carries a Zacks Rank #2.

Sell These Stocks. Now.

Just released, today's 220 Zacks Rank #5 Strong Sells demand urgent attention. If any are lurking in your portfolio or Watch List, they should be removed immediately. These are sinister companies because many appear to be sound investments. However, from 1988 through 2016, stocks from our Strong Sell list have actually performed 6X worse than the S&P 500. See today's Zacks "Strong Sells" absolutely free >>

Comerica Incorporated (CMA): Free Stock Analysis Report

M&T Bank Corporation (MTB): Free Stock Analysis Report

Fifth Third Bancorp (FITB): Free Stock Analysis Report

Moody's Corporation (MCO): Free Stock Analysis Report

Original post

Zacks Investment Research