- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

HCI Group (HCI) Q4 Earnings Beat Estimates, Revenues In Line

HCI Group, Inc.’s (NYSE:HCI) fourth-quarter 2017 net earnings per share of $1.14 beat the Zacks Consensus Estimate of 82 cents by 39.02%. Also, the bottom line more than doubled year over year on lower expenses.

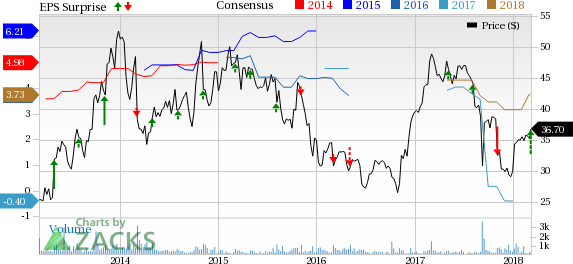

HCI Group, Inc. Price, Consensus and EPS Surprise

Behind the Headlines

Total operating revenues of $62 million declined 13.9% year over year. This downside can be attributed to lower net investment income and a decrease in premiums earned. The top line met the Zacks Consensus Estimate.

Gross premiums earned of $87.9 million fell 4.9% year over year, primarily due to policy attrition.

Net investment income of $2.9 million declined 5.5% year over year.

Losses and loss adjustment expenses dropped nearly 49% year over year to $23.2 million, resulting from the impact of Hurricane Matthew and reserve strengthening during the fourth quarter of 2016.

Total operating expenses declined 32.8% year over year to $44.7 million.

Loss ratio contracted 3010 basis points to 41.6% while expense ratio expanded 530 basis points to 38.5% in the reported period. Combined loss and expense ratio improved 2480 basis points to 80.1%.

Full-Year Highlights

HCI Group incurred loss of 75 cents per share against $2.92 earned in 2016.

Total revenues of $244.4 million decreased 7.6% year over year.

Combined ratio to gross premiums earned was 72.6% compared with 57.5% in 2016.

Financial Update

As of Dec 31, 2017, HCI Group had cash and investments of $255.9 billion, down 8.8% from $280.5 million at 2016-end.

Long-term debt of $237.8 million at 2017-end increased 71.2% from 2016-end level.

Stockholders’ equity decreased 20.4% from 2016-end level to $194 million at the end of 2017.

Book value per share of $22.14 as of Dec 31, 2017 lessened 12.2% year over year.

Zacks Rank

HCI Group carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other players from the insurance industry that have reported fourth-quarter earnings so far, the bottom line of The Progressive Corporation (NYSE:PGR) , The Travelers Companies, Inc. (NYSE:TRV) and RLI Corp. (NYSE:RLI) topped the respective Zacks Consensus Estimate.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks. >>

RLI Corp. (RLI): Free Stock Analysis Report

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

HCI Group, Inc. (HCI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.