- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Synopsys' (SNPS) $500M Share Buyback Authorization Restored

Synopsys Inc. (NASDAQ:SNPS) approved an extension of its existing share repurchase authorization to make it worth $500 million again. The initiative reflects the California-based company’s sound financial position and favorable prospects.

Synopsys' board of directors approved the stock repurchase program first in 2002. The decision reflects the company's trend of returning wealth to its shareholders from time to time, depending on market conditions.

Trac Pham, chief financial officer of Synopsys, stated, "We are pleased to be in a position to extend our share repurchase program with this new authorization and will continue to balance return of capital to stockholders, debt reduction and strategic investments to grow the business."

Synopsys’ financial strength allows it to continue with its buyback program. The company exited the last reported quarter (second-quarter fiscal 2017) with cash, cash equivalents and short-term investments of $1.131 billion million compared with $966.3 million at the end of the previous quarter. During the same quarter, cash flow from operational activities was $123 million. The company repurchased $100 million of its common stock during the quarter. The company has a remaining $235 million for its current authorization. The company’s aggressive share repurchase policies are expected to boost investors’ confidence.

In February, the company entered into a fresh accelerated share repurchase agreement (ASR) with Wells Fargo (NYSE:WFC) Bank NA. The new ASR agreement is valued at $100 million. Per the agreement, Synopsys will initially receive approximately 1.12 million shares while the remaining shares will be received on or before May 17, 2017, depending on the completion of purchase.

Last words

Synopsys is a vendor of electronic design automation (EDA) software to the semiconductor and electronics industries. We believe the company’s recent product launches, acquisitions and deal wins will boost results, going ahead. Unique intellectual properties and global support provided by the company is likely to drive its forthcoming results. Additionally, the acquisition of Cigital and Codiscope will enable Synopsys to offer a comprehensive software security signoff solution to its customers.

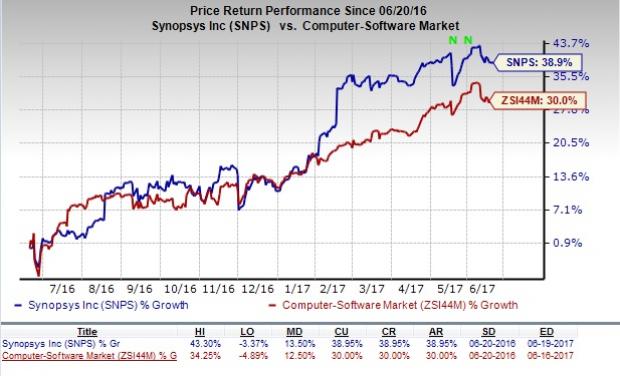

Shares of the company have returned 38.95% in the last one year, outperforming the Zacks Computer-Software industry’s gain of 30%.

Other companies that have a consistent record of returning value through share repurchases and dividend payments are Apple Inc. (NASDAQ:AAPL) , Electronic Arts Inc. (NASDAQ:EA) and Accenture plc (NYSE:ACN) .

We believe that apart from enhancing shareholders’ return, these initiatives also raise the market value of the stock. Through dividend payouts, companies bolster investors’ confidence, persuading them to either buy or hold the scrip. Looking ahead, Synopsys remains confident of its growth potential, thereby raising hopes for a further increase in shareholder value through dividend payouts and share buybacks.

However, competition from Cadence Design Systems Inc. and Mentor Graphics Corp., a challenging technology spending environment and uncertainty regarding the exact time of realizing acquisition synergies keep us on the sidelines.

Currently, Synopsys carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Apple Inc. (AAPL): Free Stock Analysis Report

Synopsys, Inc. (SNPS): Free Stock Analysis Report

Electronic Arts Inc. (EA): Free Stock Analysis Report

Accenture PLC (ACN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.