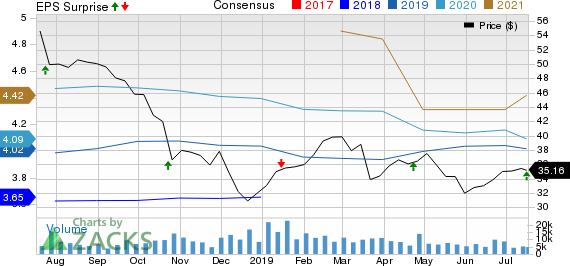

Following Synovus Financial’s (NYSE:SNV) second-quarter 2019 results, its shares have climbed 2.24%. Driven by top-line strength, the company reported a positive earnings surprise of 1.01%. Adjusted earnings of $1.00 per share beat the Zacks Consensus Estimate of 99 cents. Also, the reported figure comes in 8.4% higher than the prior-year quarter tally.

Higher revenues, backed by strong loan balances, stoked organic growth. Notably, lower efficiency ratio and rising fee income were tailwinds. However, escalating expenses and provisions were undermining factors.

Including certain non-recurring items, net income available to common shareholders came in at $153 million or 96 cents per share compared with $108.6 million or 91 cents per share recorded in the prior-year quarter.

Top Line Robust, Expenses Flare Up

Adjusted total revenues in the second quarter came in at $488.3 million, up 35.9% year over year. Further, the top-line figure outpaced the Zacks Consensus Estimate of $479 million.

Net interest income surged 39.6% year over year to $397.3 million. Yet, net interest margin shrunk 17 basis points year over year to 3.69%.

Non-interest income climbed 22.4% on a year-over-year basis to $89.8 million, including a favorable adjustment in the fair value of private equity investments. Rise in almost all components of income drove this upside.

Non-interest expenses came in at $264.1 million, flaring up 29.4% year over year. Notably, rise in almost all components of expenses resulted in this upswing.

Adjusted efficiency ratio came in at 52.08% as compared with 56.41% reported in the year-earlier quarter. A decline in ratio indicates improvement in profitability.

Total deposits came in at $38 billion, decreasing 1.1% sequentially. Total loans, however, climbed 5.7% sequentially to $36.1 billion.

Credit Quality: A Mixed Bag

Credit quality was a mixed a bag for Synovus in the June-end quarter.

Non-performing loans were up 5.8% year over year to $124.1 million. The non-performing loan ratio came in at 0.34%, contracting 13 bps year over year.

Total non-performing assets amounted to $139.6 million, underlining a rise of 10.5% year over year. The non-performing asset ratio shrunk 11 bps year over year to 0.39%.

Net charge-offs plunged 33.7% on a year-over-year basis to $11.8 million. The annualized net charge-off ratio was 0.13%, down 16 bps from the year-earlier quarter. Provision for loan losses was up 2.8% year over year to $12.1 million.

Strong Capital Position

Tier 1 capital ratio and total risk based capital ratio were 10.09% and 12.11%, respectively, compared with 11.25% and 13.08% as of Jun 30, 2018.

Also, as of Jun 30, 2019, Common Equity Tier 1 Ratio (fully phased-in) was 9.61% compared with 10.12% witnessed in the year-ago quarter. Tier 1 Leverage ratio was 8.92% compared with 10.03% recorded in the comparable period last year.

Capital Deployment Update

During the April-June quarter, the company increased the share repurchase authorization from $400 million to $725 million, and completed share buyback worth $25 million.

Our Take

Synovus’ results were quite decent in the June-end quarter. We believe the company’s focus on both organic and inorganic growth, together with its cost-containment efforts, will pay off and aid bottom-line expansion in subsequent years. Though escalating expenses raise concerns, lower efficiency ratio indicates optimism.

Citigroup Inc. (C): Free Stock Analysis Report

Wells Fargo & Company (NYSE:WFC): Free Stock Analysis Report

Synovus Financial Corp. (SNV): Free Stock Analysis Report

The Goldman Sachs Group, Inc. (GS): Free Stock Analysis Report

Original post