- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Grocery Gunfight: Can Incumbents Fend Off Amazon?

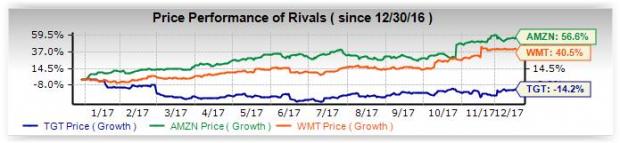

On Dec 13, Target Corporation (NYSE:TGT) made significant headway in the same-day delivery race by acquiring grocery delivery company Shipt for $550 million. The landmark deal was a must do for Target given the rapidly changing retailer landscape. In the current scenario, failure to offer same-day store to home delivery could mean curtains for nearly every retailer.

Already, Wal-Mart Stores, Inc. (NYSE:WMT) is beginning to offer grocery pickups at more of its outlets and is looking to launch same-day delivery services. Amazon.com Inc. (NASDAQ:AMZN) is also making concerted efforts on this front, with more such initiatives likely following its much vaunted Whole Foods acquisition.

This is why Target had no choice but to snag a delivery specialist like Shipt. Moreover, Target is looking to protect its online sales kitty, which swelled to 24% during last quarter.

Why Did Amazon’s Whole Foods Buy Change the Game?

But it was Amazon that fired first in what is developing into a grocery gunfight of sorts. In June, the online retail behemoth announced it was buying premium supermarket chain Whole Foods for $13.7 billion. This was Amazon’s largest ever acquisition, easily exceeding the $1.2 billion for which it picked up Zappos eight years ago.

Amazon had little choice but to add a chain like Whole Foods to its arsenal. Most of its technology driven food sales initiatives have been ridden with flaws. Even its much vaunted Amazon Go launch has met with little success.

This is why it has failed to challenge the dominance of Wal-Mart in the grocery space despite its tremendous success with books, electronics and streaming services. Wal-Mart has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In this situation, picking up Whole Foods was a smart move. Amazon can now combine Whole Foods’ fresh foods procurements expertise with its own data mining techniques. Now, Whole Foods can utilize the online behemoth’s experience to develop a better profile of its customers’ behavior. This will ensure that it offers the correct product at the right price with near immaculate timing.

How Can Traditional Retailers Respond?

For several years now, groceries were an insular market, safe from the e-commerce assault laying waste to other retail segments. In fact, only around 2% of the $800 billion U.S. groceries market has gone online till now, per data from RBC Capital Markets.

But the Whole Foods takeover has caused a tectonic shift in the grocery landscape. Analysts are now betting that Amazon will soon make major forays into the grocery space because of its logistics and data mining expertise. This could cause nearly 10% of grocery purchases to move online.

This means that the legacy supermarket business needs to learn how to deal with such a large volume of online purchases. One option to satisfy these orders would be to develop an in-house delivery structure. But this would likely be an exhaustive and costly process. This is why most of them are depending on e-delivery experts.

Both Shipt and Instacart follow a similar business model. These companies have entered into partnerships with retailers whose products at a specific store are offered online. When a customer places an order with say Shipt, a shopper visits the store in question, picks up the groceries and completes the delivery. Grocery delivery companies like Shipt usually charge customers a yearly fee for their services.

How Target Plans to Leverage the Shipt Buyout

Earlier this year, Target acquired software company Grand Junction which is also part of the same-day delivery space. With Target already offering same-delivery in New York City, the Shipt purchase will only add to Target’s delivery muscle. Target is now looking to offer same-day delivery services from half of its stores in six months and from all stores by the end of 2018.

Target will also add selections from electronics and other retail categories to the delivery baskets of Shipt. The ultimate target is to offer same-day delivery from Target’s website and mobile app. Meanwhile, Shipt will continue to work with Target’s competitors since a critical volume of business is required to make operations viable.

No Brainer Gainers: Delivery Startups

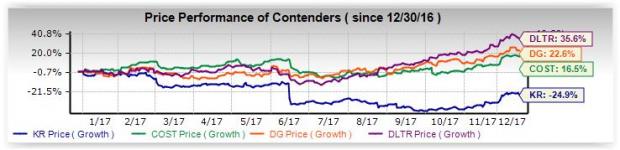

Even before its Shipt acquisition, Target was working with its competitor Instacart across several markets. The United States’ largest grocery chain The Kroger Co. (NYSE:KR) works with both these grocery delivery companies. Meanwhile, privately held Albertsons will utilize Instacart’s services to provide home delivery.

As for Shipt itself, since it will continue to operate as an independent entity, it will serve Target competitors like Kroger and Costco Wholesale Corporation (NASDAQ:COST) . Such a scheme of things implies that Amazon’s purchase of Whole Foods has come as boon for grocery delivery startups instead of the body blow it was initially perceived to be.

In fact, the Whole Foods acquisition has improved the profile of the grocery delivery segment. They are now the natural allies of traditional retailers in their war against Amazon. Since June, Shipt’s orders have jumped 60% and it has forayed into 22 new geographical areas. By next year, Shipt predicts that its revenues will hit $1 billion.

The Last Word

The Whole Foods takeover came as a rude awakening for traditional retailers. But they have learnt to survive and even thrive in a new environment, leveraging the strengths of relatively unknown grocery startups. This emerging segment has gained in the process, which means that Amazon may find that mastering the grocery business may be a much tougher challenge than it appeared at first glance.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Kroger Company (The) (KR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.