The sad and rather inevitable scenes from Athens yesterday have only served to emphasise the problem with the notion of further austerity in Greece. The latest round of cuts were passed by politicians in a vote yesterday evening, but the enforcement and implementation of these measures are where the pain lies. In the meantime what it has done is ensure that one further box has been ticked to allow the EU/ECB/IMF troika complete the next payment of aid money to Greece and prevent a calamitous default. A default is still likely, indeed probable, however.

The focus now switches back to Brussels and the labyrinthine of discussions surrounding the haircuts that will be imposed on private sector holders of Greek debt. The EU this week must also approve the measures voted on by the Greeks and will be looking for an explanation as to how the EUR300m hole in the budget will be filled if it is not to come from public sector pensions.

Despite the scenes of unrest Asian markets are higher this morning following slips on Friday. GBPEUR is once again testing the lows of the range it’s sat in over through the past month. The risk is definitely that the euro strength continues if the policy timetable of securing the possibility of default is adhered to in the coming weeks. We would likely need some poor data from the UK as a catalyst as well, UK CPI coming in weaker than expected tomorrow for example. This may be unlikely given Friday’s surprise jump in PPI.

Another major economy saw its Q4 GDP number crash into the negative overnight as Japan reported a shrinkage of 0.6%. While there has been one-off factors (floods in Thailand affecting the supply chain) the strength of the yen has hammered the export community and, as we highlighted in last week’s weekly update, the pressure to intervene to weaken the currency must have reached fever pitch. The longer term picture is ok and a lot of the drop can be attributed to a fall in government spending following the huge expansion following the tsunami 11 months ago. The Japanese economy is expected to grow by around 1.7% in 2012.

The most important market news today will be an Italian bond auction at 10am. This follows S&P’s decision (remember them?) to downgrade 34 Italian banks on Friday evening citing funding issues, a strange decision 2 weeks before the next leg of the LTRO.

Good luck.

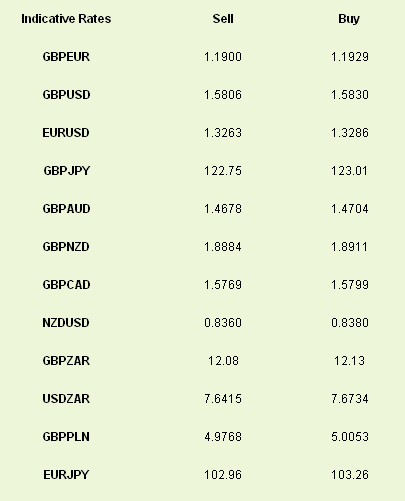

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Greece on the Brink (But of What?)

Published 02/14/2012, 12:38 AM

Updated 07/09/2023, 06:31 AM

Greece on the Brink (But of What?)

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.