The energy sector has given impressive performances in the last few months on improving demand and supply dynamics. The ultra-popular ETFs Energy Select Sector SPDR XLE, Vanguard Energy ETF (NYSE:XLE) VDE, iShares U.S. Energy ETF IYE and Fidelity MSCI Energy Index ETF FENY gained 3.3%, 2.4%, 2.7% and 2.4%, respectively, in the last three months (read: Energy ETFs Head to Head: XLE vs. VDE).

The upside has been supported by strong Q3 earnings expectations. This is especially true as total earnings for the sector are expected to be up 136% from the same period last year on 16.7% higher revenues, as per the latest Earnings Trends. In fact, it is once again the major contributor to the S&P 500 earnings and revenue growth in Q3.

Let’s delve into the earnings picture of two oil biggies, Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX) , which dominate the above-mentioned funds’ portfolio and have the power to move the funds up or down in the coming days. Both firms are slated to release their earnings before the market opens on Oct 27 and collectively make up for 41.5% for XLE, 40.4% for IYE, 39.3% for FENY and 36.8% for VDE (see: all the Energy ETFs here).

According to our surprise prediction methodology, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) when combined with a positive Earnings ESP is likely to come up with an earnings beat. A Zacks Rank #4 or 5 (Sell rated) is best avoided going into the earnings announcement, especially when the company is seeing negative estimate revisions. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

What’s in the Cards?

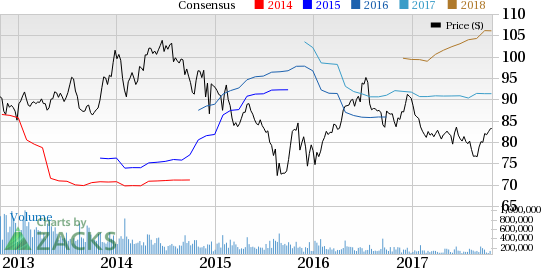

Exxon Mobil has a Zacks Rank #2 and an Earnings ESP of +1.91%, indicating higher chances of beating estimates this quarter. The stock saw a positive earnings estimate revision of a nickel over the past 30 days for the to-be-reported quarter and delivered positive earnings surprises of 8.94% on average over the last four quarters. Further, its earnings are expected to grow an impressive 38.89%. The stock has a solid Growth and Momentum Style Score of B and A, respectively, and a Value Style Score of C (read: 4 ETFs to Capitalize on the Oil Rally).

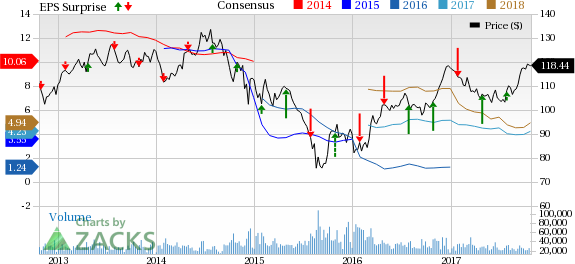

Chevron has a Zacks Rank #3 and an Earnings ESP of -1.93%, indicating less chances of beating estimates this quarter. The company is expected to see substantial earnings growth of 48.96% year over year for the to-be-reported quarter. It delivered an average positive earnings surprise of 19.35% in the last four quarters and has witnessed a positive earnings estimate revision of seven cents over the past 30 days. The stock has a solid Momentum Style Score of A, and Value and Growth Style Score of C each.

Conclusion

The duo has a favorable Zacks Rank and saw a positive earnings revision trend. Analysts increasing estimates right before earnings — with the most up-to-date information possible — is a good indicator. Though the above-mentioned ETFs have a Zacks ETF Rank #4, solid year-over-year earnings growth could provide some upside to these ETFs in the near term.

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week. Get it free >>

SPDR-EGY SELS (XLE): ETF Research Reports

ISHARS-US EGY (IYE): ETF Research Reports

FID-ENERGY (FENY): ETF Research Reports

VIPERS-ENERGY (VDE): ETF Research Reports

Chevron Corporation (CVX): Free Stock Analysis Report

Exxon Mobil Corporation (XOM): Free Stock Analysis Report

Original post