ran an interesting story today about the possibility that Spain may begin an economic recovery fairly soon. In particular, two items that are worth pointing out may provide some tailwind for Spain's economy.

1. Exports:

CNBC: ... a healthy export sector that has increased market share throughout the recession; of these exports, steel and chemicals make up for 26 percent of the total, followed by capital goods (20 percent) and automobiles (17 percent); food products, Spain's traditional source of foreign exchange, are now only 16 percent of the total.

2. Improved competitiveness in the labor markets -- something that France, for example, is struggling with (see post).

CNBC: While public servants have had pay cuts of between 10 and 25 percent, cuts of 20 to 40 percent are not uncommon in the private sector. In short, Spain has regained competitiveness and is in a position to benefit from growth in her trading partners.

This second item is particularly interesting given Spain's large temp workforce which provides an additional level of flexibility (see discussion).

The one area the article didn't discuss in sufficient detail is Spain's banking system other than to say that the restructuring is nearly complete.

CNBC: The restructuring of the banking system is nearly completed (partly at the cost of a higher public deficit), and de-leveraging of the banking sector is slowly proceeding (from 19 in 2007 to 16.7 in 2011)

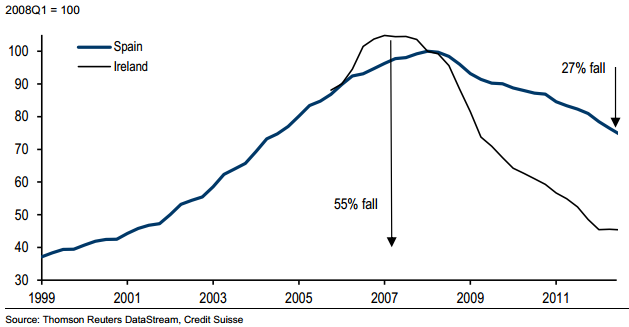

Technically Spain has made the right moves toward stabilizing the banking system. More importantly the ECB has been instrumental in bringing some degree of confidence and stemming depositor flight out of the country (see discussion). But the Spanish banking system, especially among domestically focused institutions, still has a long way to go before it becomes fully functional. In particular analysts feel that the housing correction in Spain has not run its full course, which means that property loan portfolios have a long tail of failures (see post). Clearly Ireland's situation was different, but the comparison below leaves investors asking questions.

We are certainly going to see economic improvements in Spain in the next couple of years, but the full blown recovery may be some time away.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Good Signs From Spain But Recovery Remains Distant

Published 03/13/2013, 11:00 AM

Updated 07/09/2023, 06:31 AM

Good Signs From Spain But Recovery Remains Distant

CNBC

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.