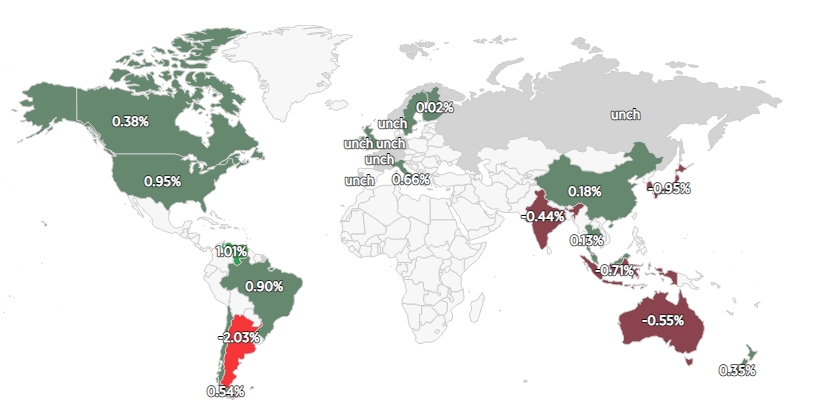

The S&P 500 advanced 1.0% on Thursday, setting a new intraday high and new record close, bolstered by expectations for easier monetary policy and lower sovereign bond yields. The Dow Jones Industrial Average gained 0.9%, the Nasdaq Composite gained 0.8%, and the Russell 2000 gained 0.5%. The Fed captured the headlines yesterday and received plenty of attention today, but the market has also been paying attention to global developments. Monetary policy is getting more dovish and sovereign bond yields continue to decline around the world.

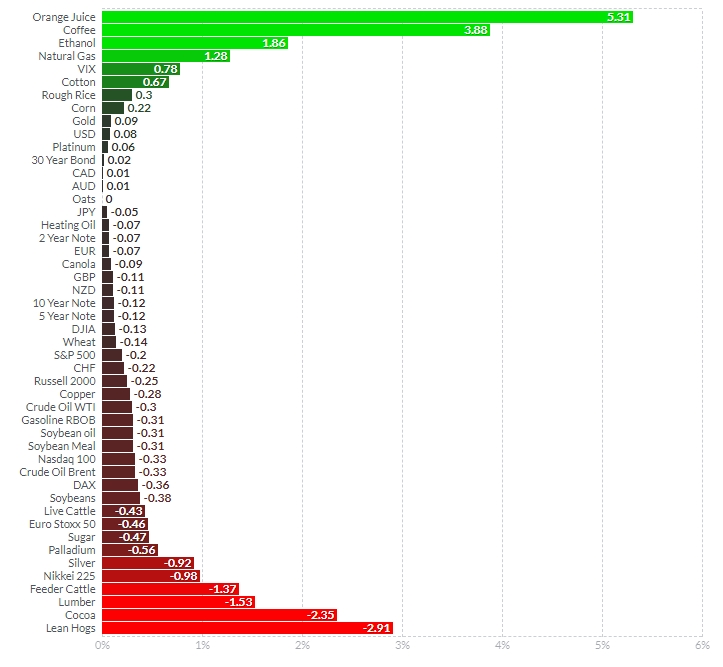

The Bank of England and the Bank of Japan both left rates unchanged on Thursday with Japan indicating its key policy rate could stay at its current level until spring 2020. Expectations for lower rates remained the biggest driver in the equity and bond markets. The 10-yr note yield and the 2-yr note yield declined three basis points each to 1.72% and 2.00%, respectively. The lower yields put some pressure on the U.S. dollar (96.65, -0.47, -0.5%) and continued to favor risk assets. Leading equities higher were the energy stocks, as oil prices ($57.12/bbl, +$3.13, +5.8%) climbed amid the weaker dollar and escalated tensions in the Middle East. Iran shot down a U.S. military drone, which President Trump said was a "very big mistake." Geopolitical tensions briefly unnerved the market before the influence of the Fed pushed stocks higher during the afternoon.The S&P 500 energy sector led all sectors higher with a gain of 2.2%. The other ten sectors finished with gains between 0.4% (health care) and 1.6% (industrials). The turnaround in the S&P 500 financials sector (+0.5%), which was down as much as 0.6% during the day, contributed to the strong finish in the broader market. In corporate news, Slack Technologies (NYSE:WORK) (WORK 38.62, +12.62, +48.5%) made its public debut, opening at $38.50 per share after the NYSE set its reference price at $26 per share. Oracle (NYSE:ORCL) (56.99, +4.31, +8.2%) pleased investors with solid earnings results, while Carnival (NYSE:CCL) (48.80, -4.04, -7.7%) disappointed investors with weak full-year guidance. Separately, gold futures also made a big move, settling 3.4% higher at $1393.95/oz on expectations that interest rates will continue to decline.

Reviewing Thursday's economic data:

- Initial claims for the week ending June 15 decreased by 6,000 to 216,000 (BlueSuisse.com consensus 220,000). Continuing claims for the week ending June 8 decreased by 37,000 to 1.662 million.

- The key takeaway from the report is that it covers the period in which the survey for the June employment report was conducted. Accordingly, the low level of initial claims should set an expectation for a solid gain in nonfarm payrolls for June.

- The Conference Board's Leading Economic Index was unchanged in May (BlueSuisse.com consensus +0.1%) following a downwardly revised 0.1% increase (from 0.4%) in April.

- The key takeaway from the report is that it reflects an environment of slower economic growth unfolding in the second quarter. According to the Conference Board, the Leading Economic Index increased 0.3% for the six-month period ending May 2019, versus 2.2% growth during the previous six months.

- The Q1 Current Account Deficit was $130.4 billion (BlueSuisse.com consensus -$125.0 billion) versus a downardly revised $143.9 billion (from -$134.4 billion) for the fourth quarter.

- The Philadelphia Fed Index fell to 0.3 (BlueSuisse.com consensus 11.5) from 16.6 in May.

Looking Ahead:

Looking ahead, investors will receive Existing Home Sales for May on Friday.

Top Market drivers:

- The S&P 500 sets a new intraday high and new record close

- Stocks buoyed by easy monetary policy expectations from central banks and lower sovereign bond yields

- Middle East tensions escalate after Iran shot down a U.S. military drone, fuels gains in oil and the S&P 500 energy sector

Strong: Energy, Information Technology, Industrials

Weak: Health Care