XAU/USD Daily" title="XAU/USD Daily" height="242" width="474">

XAU/USD Daily" title="XAU/USD Daily" height="242" width="474">

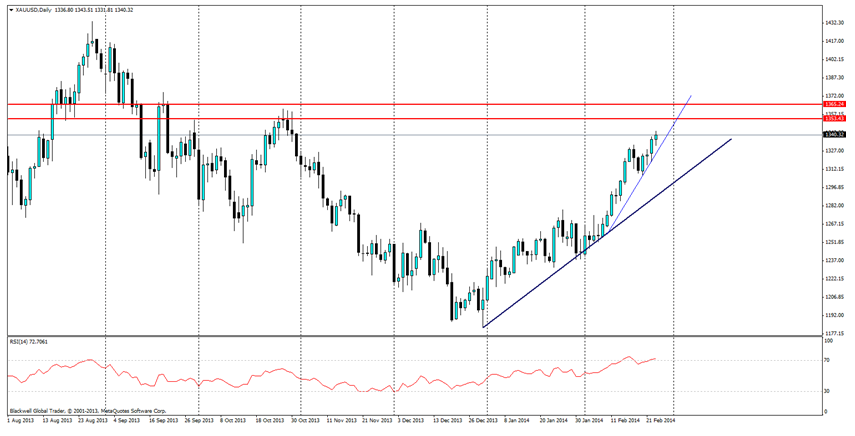

Gold has been rocketing higher on the back of economic worries and as the precious metals sector comes back into vogue. The question on peoples' minds is how much higher can it go. I certainly believe there is still more room to move upward, which has been brought on by the global risks that are becoming more and more apparent – deflation, governments changing, bitcoin collapse, all of which have played some part in shifting investors back in the Gold markets.

The question on traders' lips is: where to next? That question is fairly easy to answer.

Currently, Gold has been rising very rapidly, as can be seen by the 2 diverging trend lines. We have a constant long term bullish trend line, followed by a very steep rising one as pressure mounts upwards. Obviously, this is very attractive in terms of trending upwards, but we are starting to see overbought conditions in the RSI, which is currently pointing to a possible slow down in the near term.

Resistance levels likely to be found at 1353.43 and 1365.24, both of which are heavy tops which we are likely to see Gold consolidate at. The 1365.24 will be the level to crack, and we are likely to see pull backs from each price level, as market participants look to take profit. While a trending market upwards does make money, it’s still a risky market, and investors still have fresh in their minds, the massive declines over the last few years, as Gold markets looked to pull back over the massive highs it had experienced during the global financial crisis.

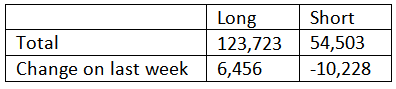

Contract changes from the U.S. Commodity Futures Trading Commission also show that most market participants are pointing to more rises, as last week saw a rise in the amount of long positions which easily doubles current short positions, at the same time short contracts saw a significant drop of 19%

So for traders out there, certainly there is real movement upwards still to come, but it’s important to pay attention to the keylevels currently in play in the market. If the market starts to pull back, I wouldn’t look to exit unless the steep trend line is broken, and might look to short briefly while it trends down to the long term bullish trend line which will likely take control upwards again.

Either way opportunities are still there no matter what position you are in for the gold market, certainly markets seem very bullish and I know I am certainly looking for further rises to the key price levels I have talked about, where we can expect to see resistance and consolidation before any further momentum in either direction.