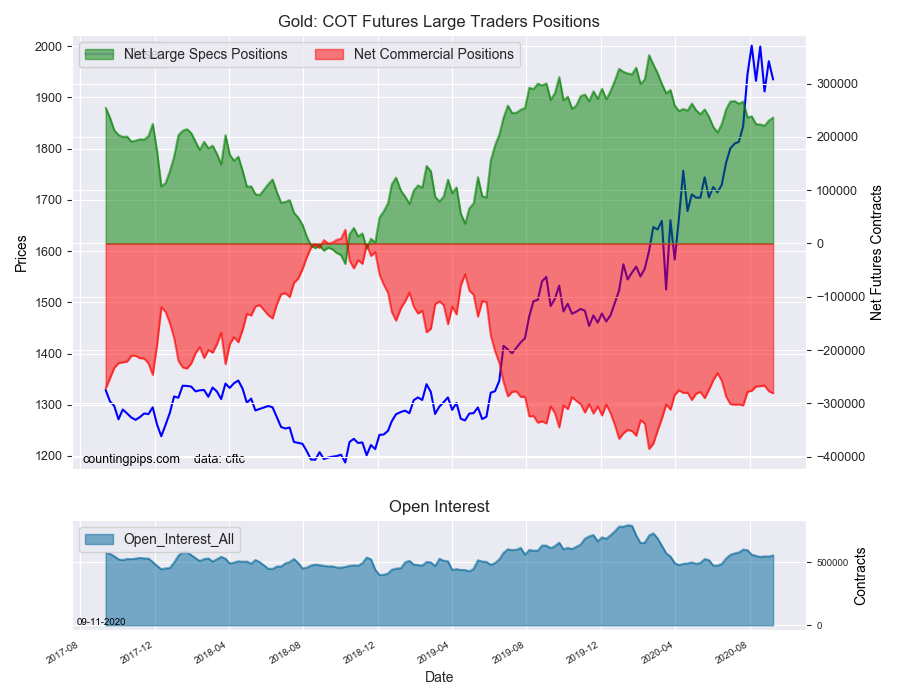

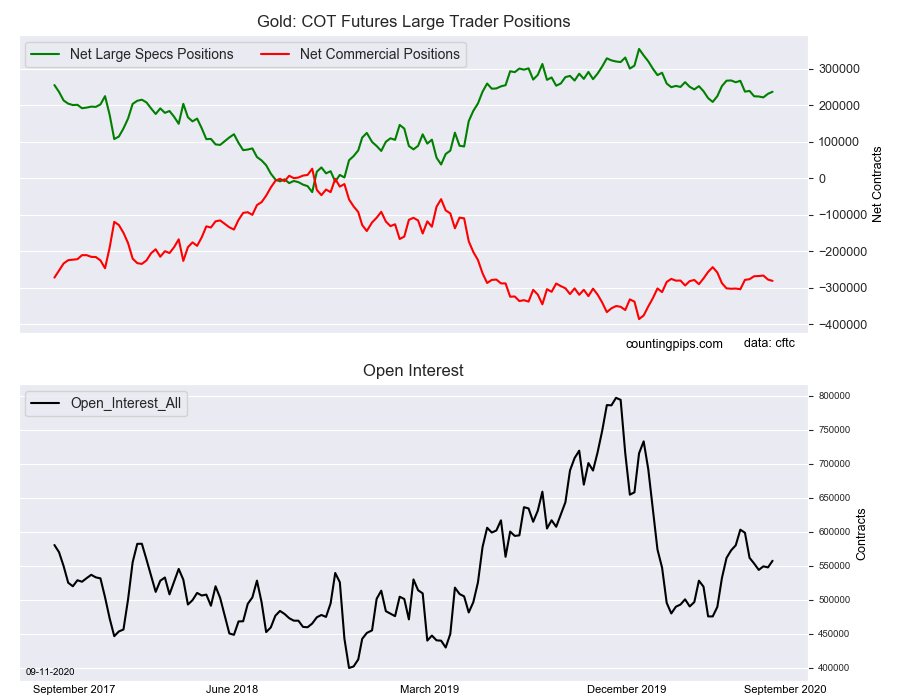

Large precious metals speculators lifted their bullish net positions in the Gold futures markets again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 236,473 contracts in the data reported through Tuesday, September 8th. This was a weekly gain of 5,677 net contracts from the previous week which had a total of 230,796 net contracts.

The week’s net position was the result of the gross bullish position (longs) rising by 7,055 contracts (to a weekly total of 313,173 contracts) while the gross bearish position (shorts) increased by a lesser amount of 1,378 contracts for the week (to a total of 76,700 contracts).

Gold speculators raised their bullish bets this week for a second straight week following a streak of three weekly declines previously. Gold speculative positions have risen by a total of +15,435 contracts over the past two weeks and have now ascended to the most bullish standing of the past five weeks above +236,000 contracts. The gold position has been trending slightly lower since hitting a record high in February but has remained consistently bullish with spec positions continuing to be above the +200,000 net contract level for sixty-five straight weeks, dating back to June of 2019.

Gold Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -281,040 contracts on the week. This was a weekly loss of -3,634 contracts from the total net of -277,406 contracts reported the previous week.

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1935.10 which was a decline of $-35.70 from the previous close of $1970.80, according to unofficial market data.