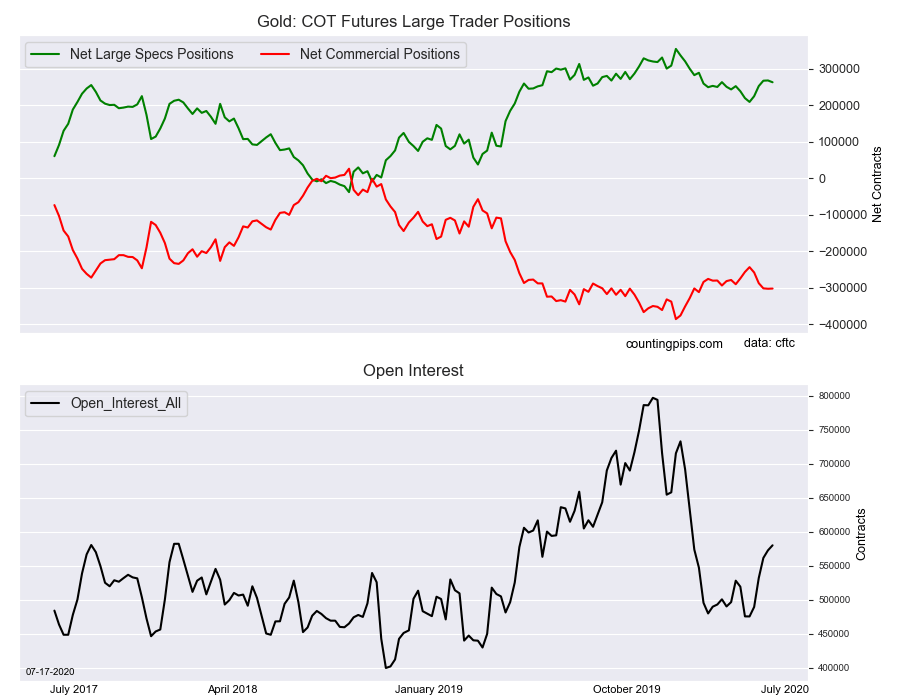

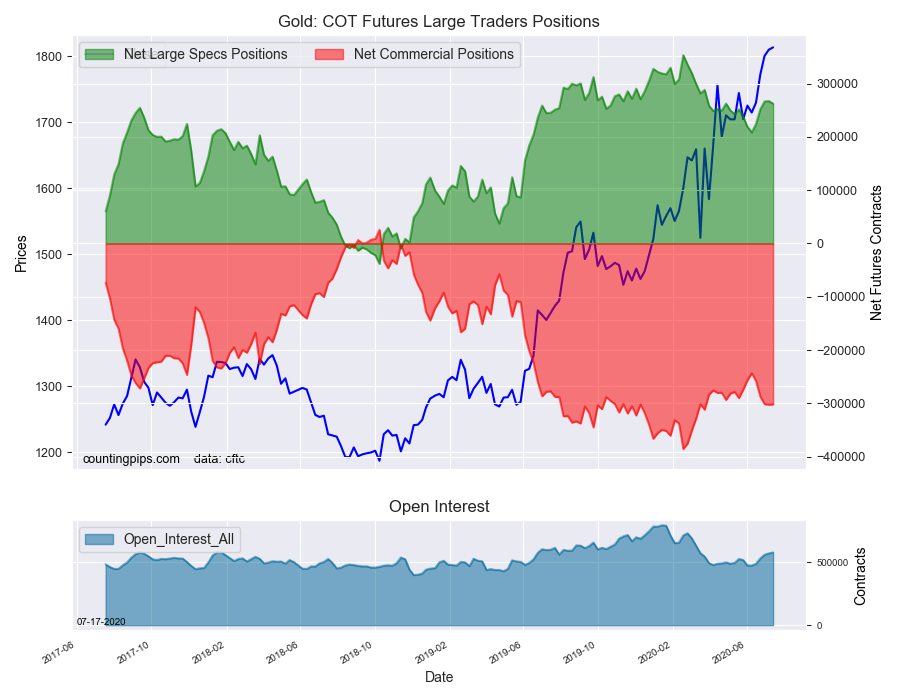

Gold Non-Commercial Speculator Positions:

Large precious metals speculators cut back on their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 262,428 contracts in the data reported through Tuesday, July 14th. This was a weekly decline of -4,930 net contracts from the previous week which had a total of 267,358 net contracts.

The week’s net position was the result of the gross bullish position (longs) dropping by -6,825 contracts (to a weekly total of 330,205 contracts) while the gross bearish position (shorts) dipped by -1,895 contracts for the week (to a total of 67,777 contracts).

Gold speculators cut back this week following four straight weeks of gains. This week’s modest pullback comes after speculators added a total of +58,745 contracts to the bullish level over the previous four weeks. The recent bullish sentiment had brought the overall standing to the highest level in fifteen weeks before this week’s slight turnaround. The speculator position has now remained above the +200,000 net contract level for a total of fifty-seven consecutive weeks, dating back to June of 2019.

Gold Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -302,018 contracts on the week. This was a weekly uptick of 574 contracts from the total net of -302,592 contracts reported the previous week.

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1813.40 which was an advance of $3.50 from the previous close of $1809.90, according to unofficial market data.