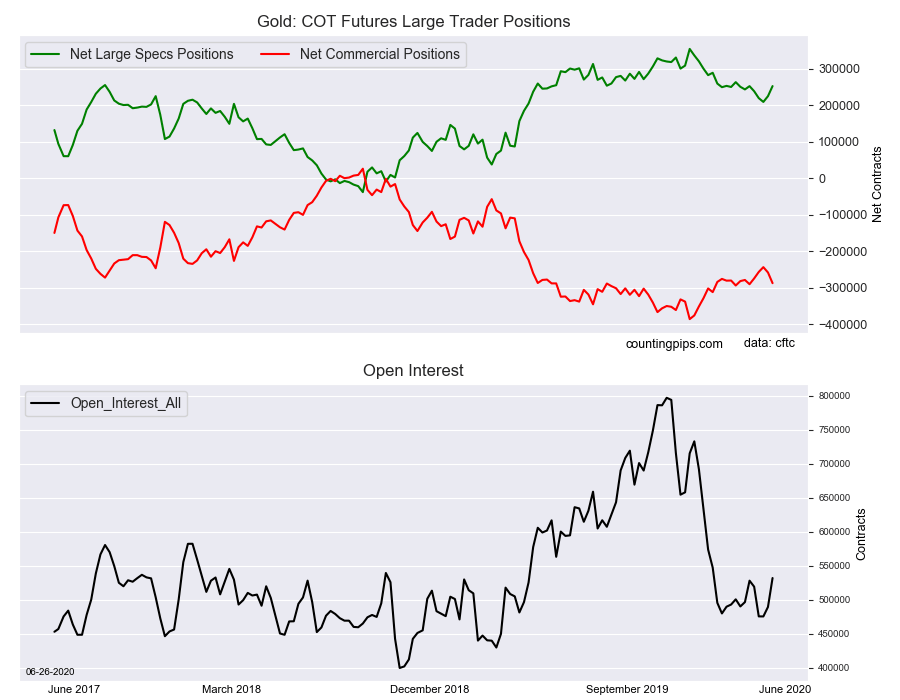

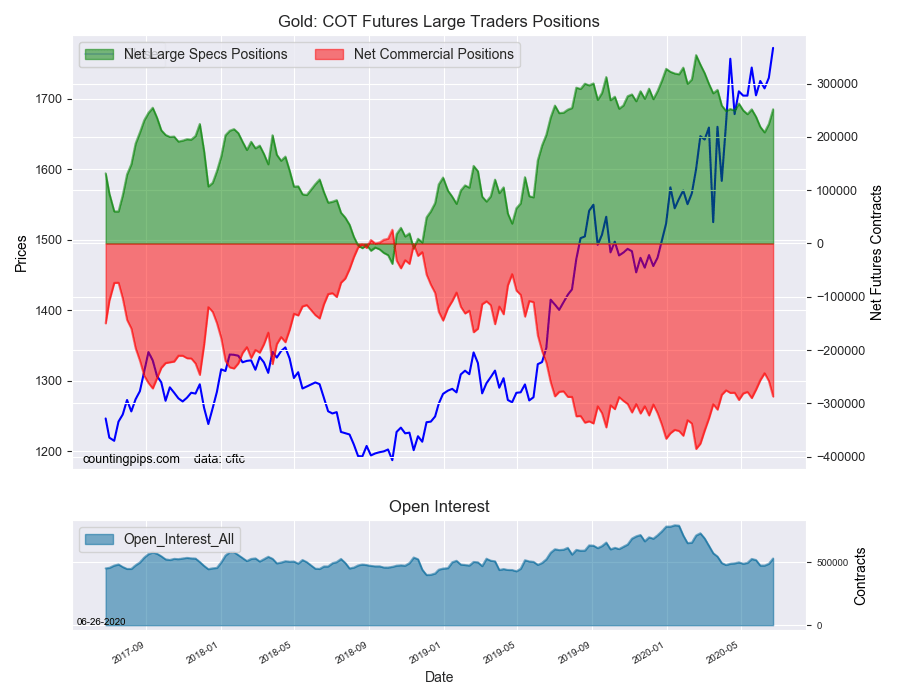

Gold Non-Commercial Speculator Positions:

Large precious metals speculators strongly raised their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 251,957 contracts in the data reported through Tuesday, June 23rd. This was a weekly gain of 27,609 net contracts from the previous week which had a total of 224,348 net contracts.

The week’s net position was the result of the gross bullish position (longs) rising by 31,064 contracts (to a weekly total of 308,459 contracts) while the gross bearish position (shorts) increased by 3,455 contracts for the week (to a total of 56,502 contracts).

Gold speculators boosted their bullish bets higher for a second straight week and this week’s total (+27,609 contracts) marked the highest one-week gain of the past eighteen weeks. The speculative position had been very much on a downtrend since late February with declines in twelve out of sixteen weeks through June 9th with an overall drop of -145,036 contracts from the bullish position. However, the last two weeks have provided a rebound for the speculative position with a total rise of +43,344 contracts over that time-frame.

Gold Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -287,292 contracts on the week. This was a weekly decline of -29,272 contracts from the total net of -258,020 contracts reported the previous week.

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1772.10 which was an uptick of $42.50 from the previous close of $1729.60, according to unofficial market data.