Gold Non-Commercial Speculator Positions:

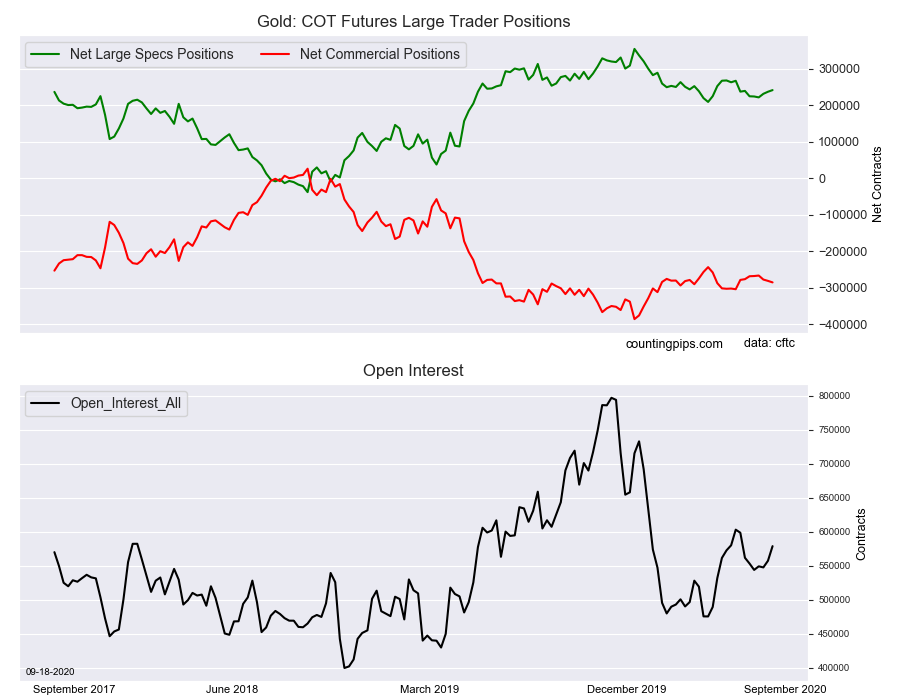

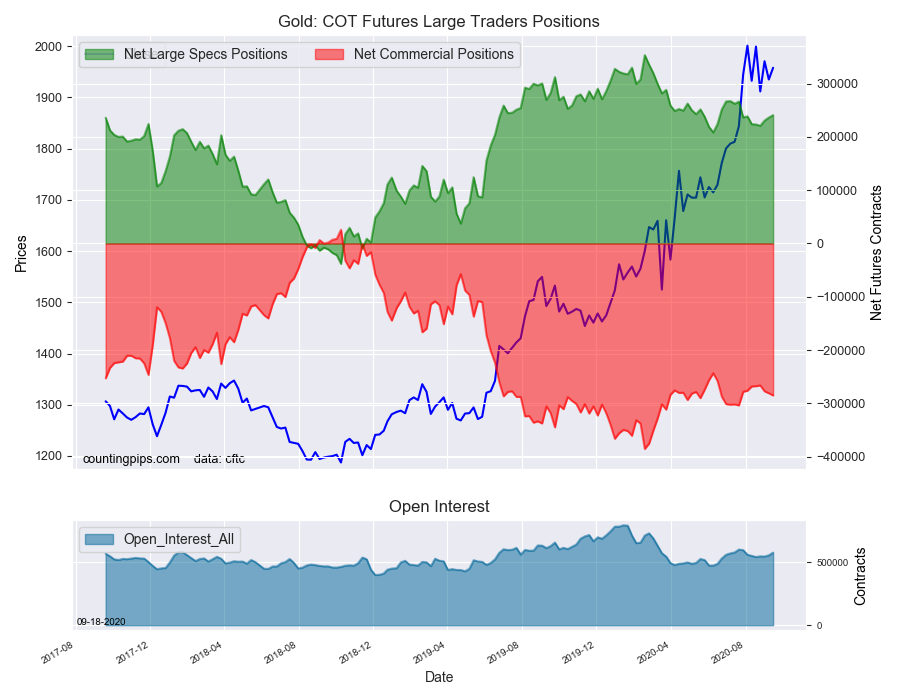

Large precious metals speculators boosted their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 240,977 contracts in the data reported through Tuesday September 15th. This was a weekly rise of 4,504 net contracts from the previous week which had a total of 236,473 net contracts.

The week’s net position was the result of the gross bullish position (longs) gaining by 11,339 contracts (to a weekly total of 324,512 contracts) while the gross bearish position (shorts) rose by a lesser amount of 6,835 contracts for the week (to a total of 83,535 contracts).

Gold speculators continued to increase their bullish positions this week for the third consecutive week. The speculative position has now risen by a total of +19,939 contracts over these past three weeks and has advanced to the most bullish standing of the past eight weeks at a total of +240,977 contracts. The positioning had cooled off over the past few months for gold bulls as the current level remains under the 2020 weekly average of +266,230 contracts. However, in the big scheme of things, the bullish position continues to be above the +200,000 contract level for the sixty-sixth straight week, dating back to June of 2019 and highlighting the consistent bullish tenor of the large speculative traders.

Gold Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -285,186 contracts on the week. This was a weekly fall of -4,146 contracts from the total net of -281,040 contracts reported the previous week.

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1958.00 which was an advance of $22.90 from the previous close of $1935.10, according to unofficial market data.