Gold Non-Commercial Speculator Positions:

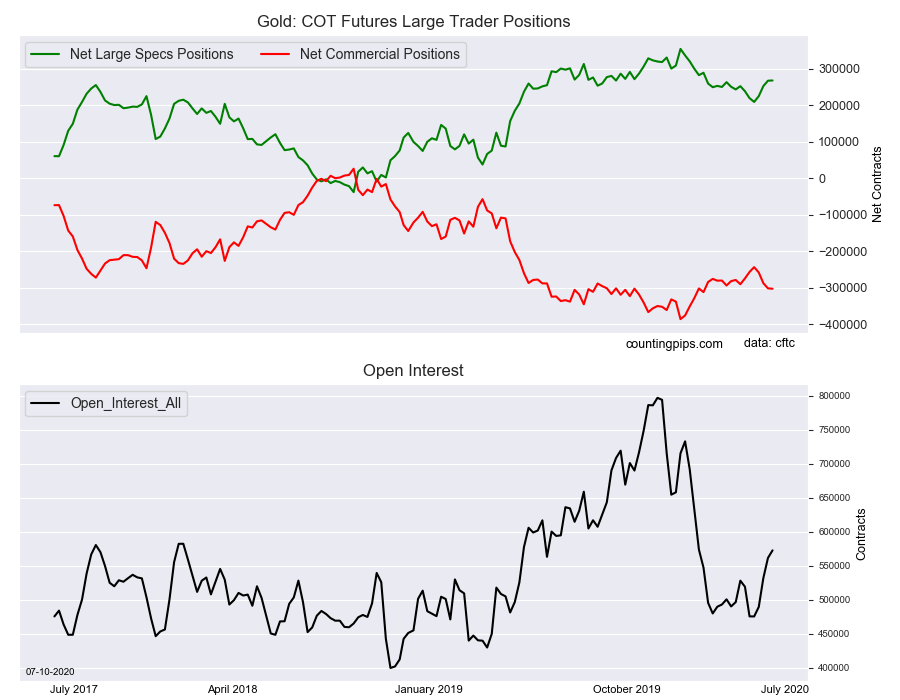

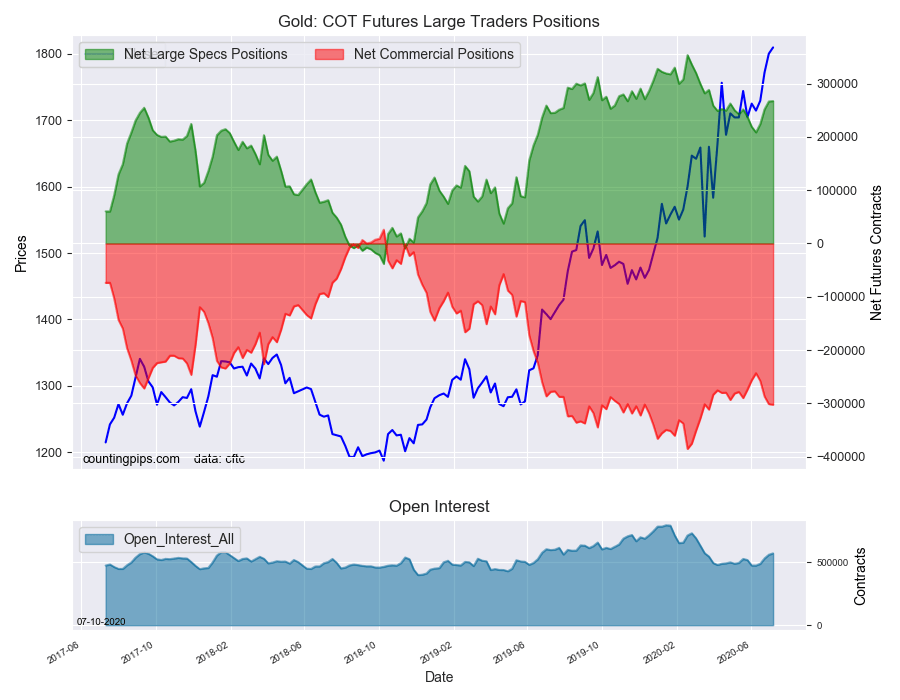

Large precious metals speculators continued to increase their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 267,358 contracts in the data reported through Tuesday, July 7th. This was a weekly gain of 688 net contracts from the previous week which had a total of 266,670 net contracts.

The week’s net position was the result of the gross bullish position (longs) growing by 8,088 contracts (to a weekly total of 337,030 contracts) while the gross bearish position (shorts) rose by 7,400 contracts for the week (to a total of 69,672 contracts).

Gold speculative positions edged higher again this week for a fourth straight week after a long stretch of declining speculator sentiment. Gold bets have now risen by +58,745 contracts in these past four weeks. Previously, gold positions had climbed to a record high position of +353,649 contracts on February 18th but then spec sentiment dropped sharply over the next sixteen weeks with a total of -145,036 contracts coming off the net position to a total of +208,613 contracts. The bullishness of these past four weeks has now pushed the overall level to the most bullish point of the past fifteen weeks.

Gold Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -302,592 contracts on the week. This was a weekly drop of -1,129 contracts from the total net of -301,463 contracts reported the previous week.

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1809.90 which was a gain of $9.40 from the previous close of $1800.50, according to unofficial market data.