Gold Non-Commercial Speculator Positions:

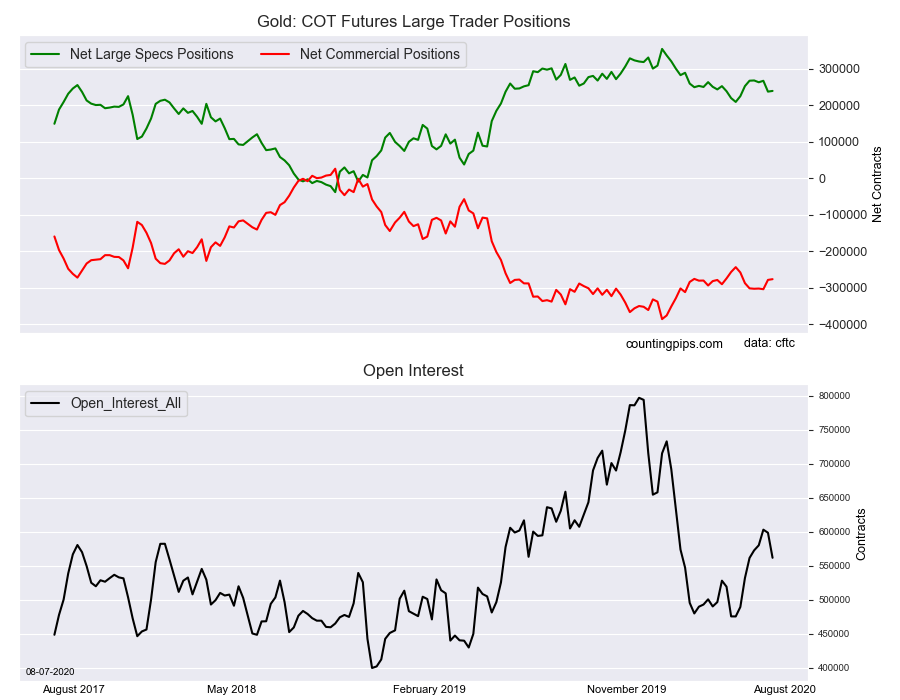

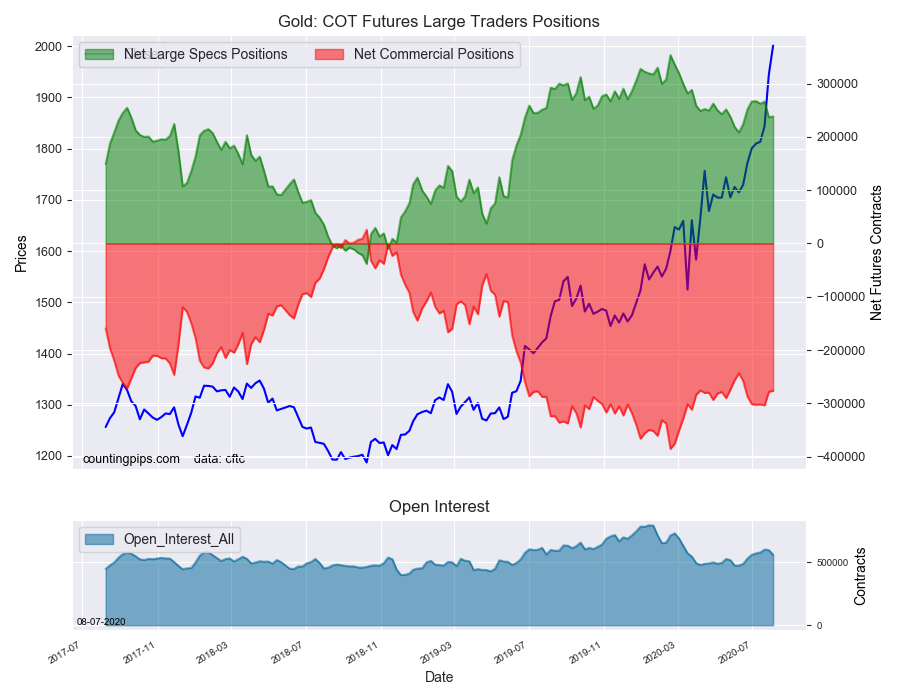

Large precious metals speculators increased their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 238,746 contracts in the data reported through Tuesday, August 4th. This was a weekly gain of 1,945 net contracts from the previous week which had a total of 236,801 net contracts.

The week’s net position was the result of the gross bullish position (longs) increasing by 9,259 contracts (to a weekly total of 321,847 contracts) while the gross bearish position (shorts) increase by 7,314 contracts for the week (to a total of 83,101 contracts).

Gold speculators slightly bumped up their bullish bets this week following a sharp drop by -29,635 contracts last week. Speculators have, however, increased their bullish bets in six out of the past eight weeks as the gold price has broken out above the $2,000 level. Overall, the gold speculative position still remains in a relatively modest bullish position at +238,746 contracts, a far distance from the +300,000 contract levels of January and February.

Gold Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -276,345 contracts on the week. This was a weekly boost of 2,032 contracts from the total net of -278,377 contracts reported the previous week.

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $2001.20 which was a gain of $56.60 from the previous close of $1944.60, according to unofficial market data.