As I have been forecasting over the last few weeks, gold's bullish trend is now developing nicely and has also given us a perfect example of volume price analysis in action on the daily chart, with the strong move higher last week on the daily chart, fully supported with rising volume and only pausing for respite on Friday. This morning’s early trading has seen the precious metal continue higher bursting through the $1,900 per ounce area and trading at $1,938 per ounce at the time of writing, and with little ahead in terms of volume resistance as price enters a low volume node, expect more to come as we rampage higher towards the $2000 per ounce region and beyond longer term.

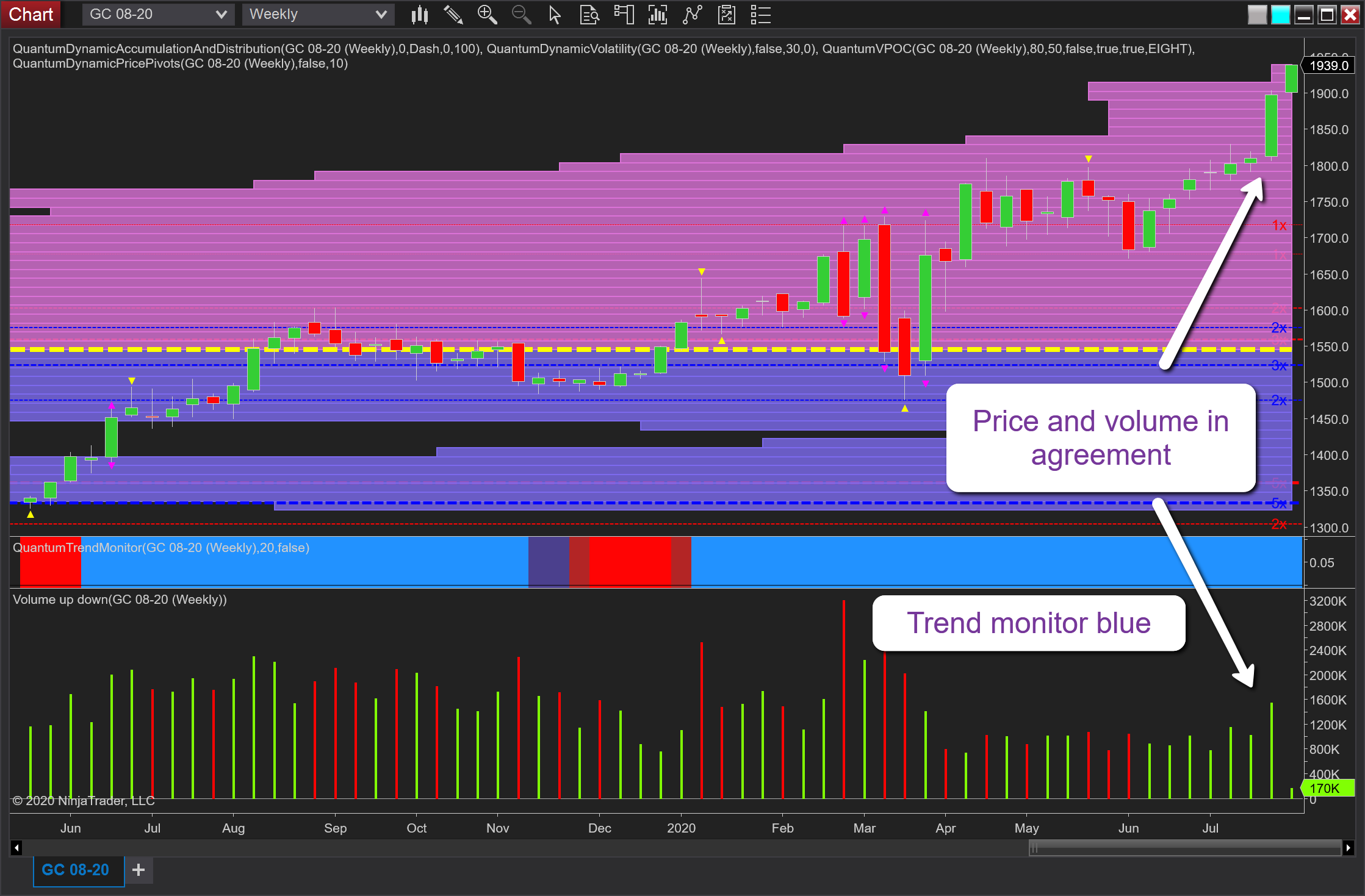

From a fundamental perspective, there is no question weakness in the U.S. dollar is offering its own support, but the primary drivers are now the prospect of longer-term inflation. Indeed, one interesting fact is that futures traders are now opting to settle in the physical metal rather than in cash, which is also helping to fuel demand and further buying of gold. The trend monitor indicator for ninjatrader continues to remain blue.

It is a similar picture on the weekly chart with strongly rising volume supporting last week’s wide spread up candle and confirming the bullish picture, as here also we are driving into a low volume node on the VPOC histogram.