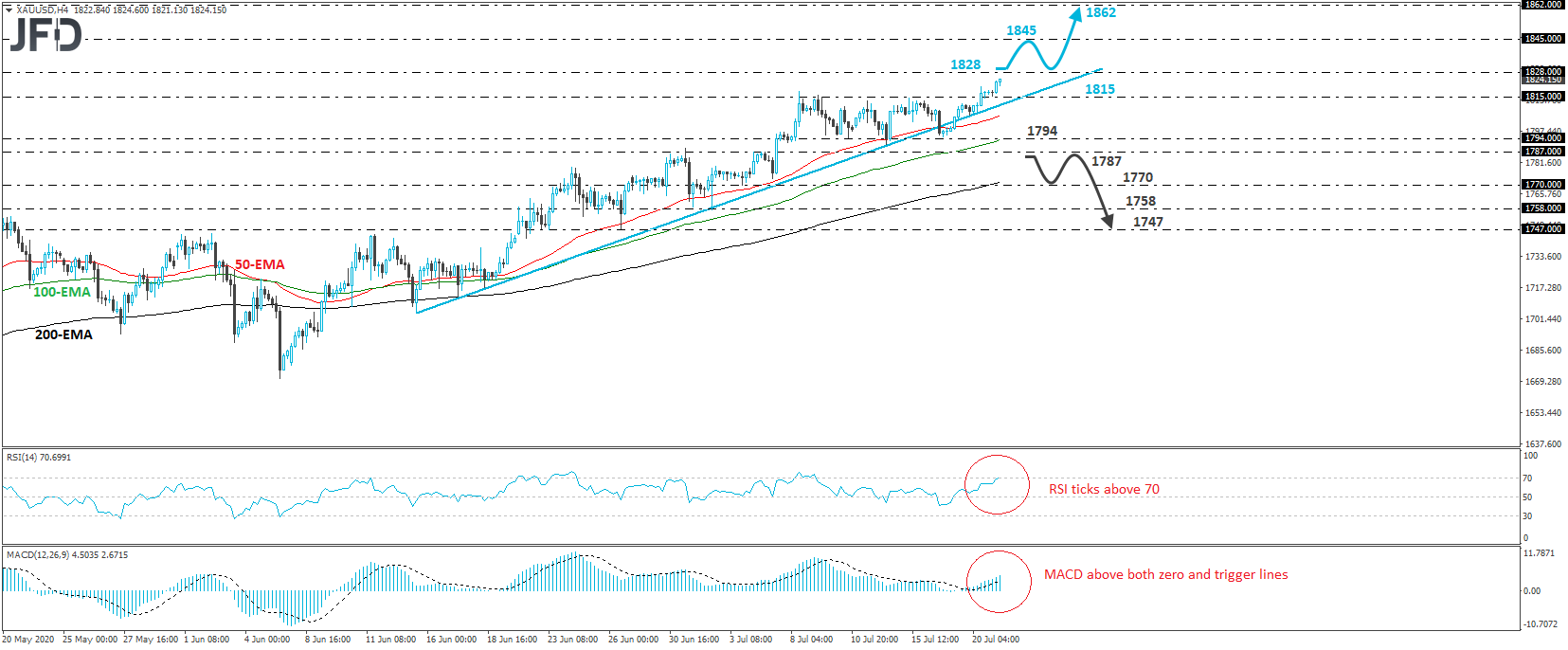

XAU/USD traded higher on Tuesday, after breaking above the 1815 key resistance area (now turned into support) on Monday. What’s more, after briefly breaking below the upside support line drawn from the low of June 15th, the metal is now trading back above that line, as well as above all three of our moving averages on the 4-hour chart. All these technical signs paint a positive picture in our view.

Now, the metal looks to be heading towards the 1828 barrier, which is marked as resistance by the high of September 19th, 2011. If the bulls are strong enough to overcome that hurdle, then we may see them targeting the high of September 14th, 2011, at around 1845. Another break, above 1845, may extend the advance towards the high of September 12th of the same year, near 1862.

Taking a look at our short-term oscillators, we see that the RSI has just ticked above the 70 line, while the MACD lies above both its zero and trigger lines, pointing up. Both indicators detect strong upside speed and corroborate the notion for the yellow metal to continue drifting north for a while more.

On the downside, we would like to see a strong dip below 1787 before we start examining the bearish case. The price would already be below the aforementioned upside line, while the break below 1787 would also confirm a forthcoming lower low. The bears may then decide to push towards the 1770 zone, the break of which may set the stage for extensions towards the 1758 level, marked by the lows of July 1st and 2nd, or the 1747 zone, defined as a support by the low of June 26th.