The next few weeks are certain to attract much attention to precious metals. Hardly anyone can argue that Gold has not experienced an incredible upside price rally over the last 12+ months. Recently, Gold closed above $1800 for the first time since 2011. Our researchers believe the next target is $1935. Keep reading to learn why we believe this is the next major price target for Gold.

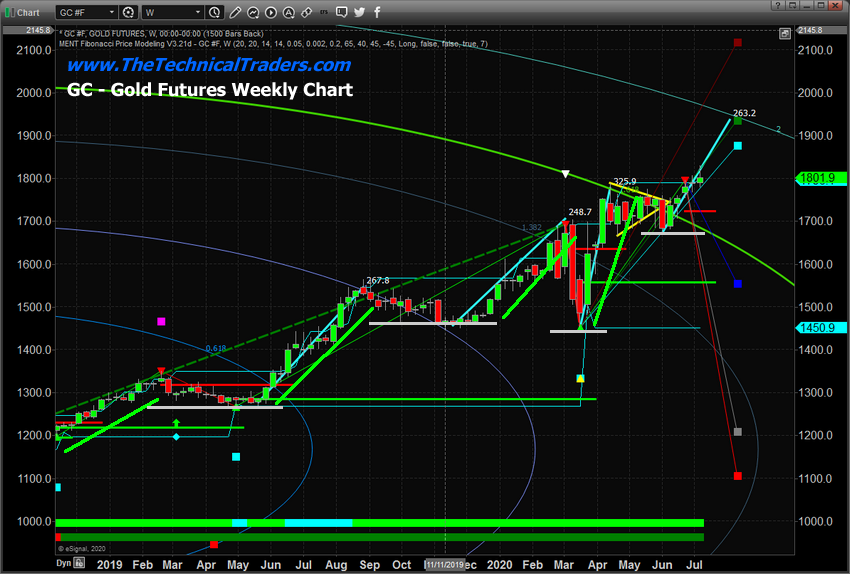

Gold Weekly Price Analysis

Over the past 18+ months, Gold continues to develop price patterns that seem to be replicating going forward. This pattern consists of an advance in price followed by consolidation/rotation in price to set up a new momentum base. The example of this price advance from May 2019 to August 2019 consisted of a $267 upside price advance (just over 20%). Subsequent advances were similar in size. November 2019 to March 2020 advance rose $248. March 2020 to April 2020 advance rose $325.

Our research team believes the current momentum base, near $1725, will prompt a rally in Gold that will target $1935 in a similar type of price advance. After that level is reached, a new momentum bottom will likely setup near $1900 which will be followed by another upside price advance. This time targeting $2150 to $2190. We believe once Gold clears the $2100 level, global investors will identify the rally more efficiently and the upside parabolic price move may extend very rapidly.

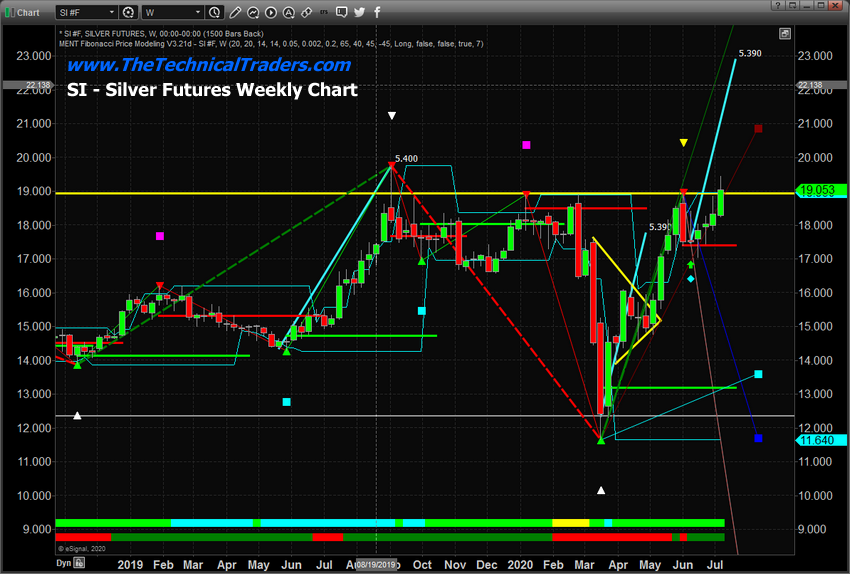

Silver Weekly Price Analysis

With Silver, the measured moves are averaging about $5.25 to $5.40 with each advance. If this continues from the current momentum base level near $17.50, then the next upside price target level should be near $23.00 in Silver. Beyond that, the subsequent target level should be near $28.00.

This would represent a massive upside price advance in Silver of nearly 59%. Ultimately, the upside move in metals illustrates a strong level of fear in the markets related to global market stability and solvency. Silver has recently begun a move above the $19.00 price level and once it clears the $21 level, the next upside price advance should be fairly quick.

We believe the early Q2 2020 earnings data may shock the markets and cause the metals markets to rally. Initially, though, the metals may move a bit lower as the markets contract from the shock. This should be short-lived as metals have already rallied to a point where investors know the fear of the shock should act to propel metals above recent momentum base levels.

Watch how Silver moves compared to Gold. Silver has already started to move more aggressively higher than Gold. Once the real parabolic move begins, Silver will begin to skyrocket much higher than Gold on a percentage basis. We should know how the metals will react to the economic data fairly quickly. If you have not already hedged your portfolio into precious metals or miners, we suggest establishing a 15% to 25% protective hedge at this time.