Gold Spot longs at our buying opportunity at 1909/07 worked perfectly with this marking a low for the day before a bounce to our first target of 1932/34 and as far as 1956.

Silver Spot more volatile than I expected with longs at 2270/60 stopped below 2250 before we shot higher from 2232 to 2474.

Today’s Analysis

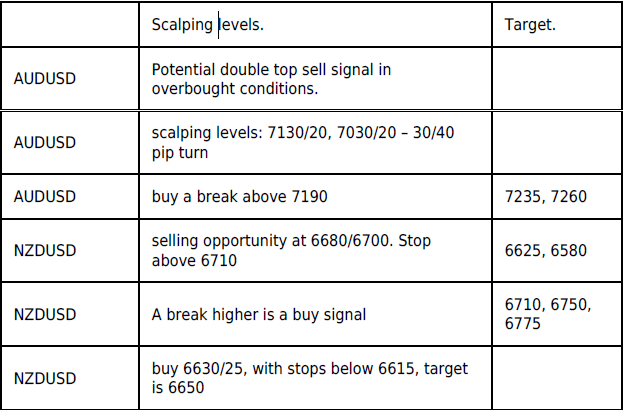

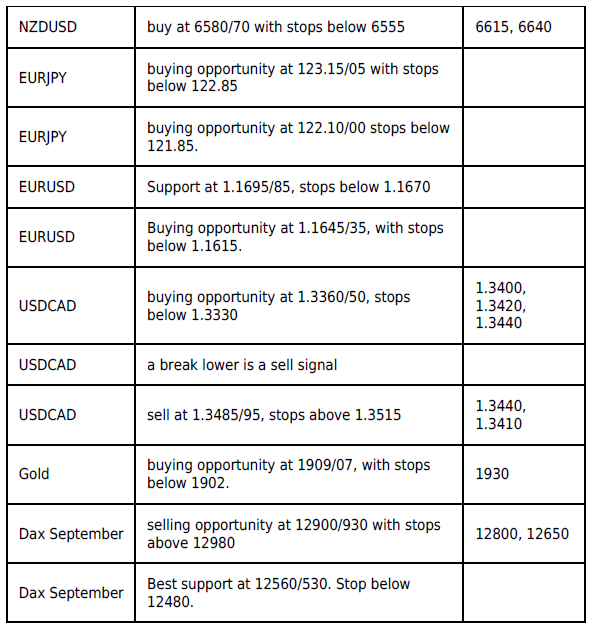

Gold looks likely to enter a sideways consolidation after such extreme gains, which will mean the odd sharp move to the downside within this pattern as bulls take profit. Should be good for scalpers now. Watch for a small bounce from first support at 1934/32 but below 1930 meets our buying opportunity at 1909/07, with stops below 1902. A break lower is a sell signal targeting 1887/85.

The upside is less clear. Minor resistance at 1952/54. Obviously we have resistance at 1980 high. Be ready to buy a break above here for 1990/93.

Silver likely to trade in a volatile sideways direction to ease overbought conditions with first resistance at 2470/72. Holding here targets 2425 with first support at 2380/78. On further losses look for 2325/22 with a buying opportunity at 2260/50, stops below 2230. However, if we continue lower look for 2180/70.

Above 2480 allows a recovery to 2535/45. Obviously we have resistance at 2610/20 highs.

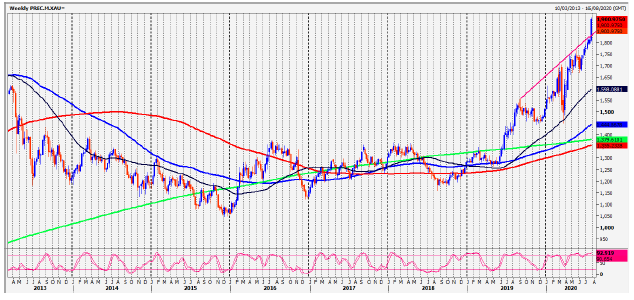

Trends

- Weekly Outlook Positive

- Daily Outlook Positive

- Short Term Outlook Positive

Chart