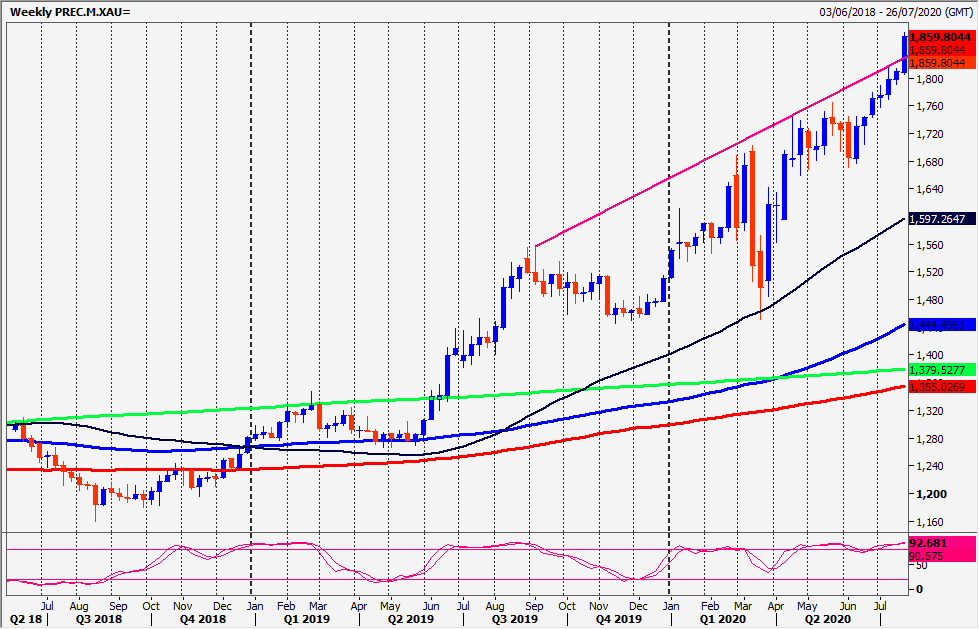

Gold Spot we wrote: trying a break above 1817 high to restart the longer-term bull trend, with next targets of 1825/27 & 1835/37.

All targets hit as we reach 1847 in the longer-term bull trend.

Silver Spot rocketed over 200 pips as the bull trend resumes, hitting 2240.

Today’s Analysis

Gold severely overbought and Gold does like to spike higher then consolidate for an extended period. However, we definitely have no sell signal. We stick with buying into any sell-off to support levels- first at 1835/33 then better support at 1825/23. Stop below 1820.

A break above 1850 targets 1875/80, 1895/1900 & eventually the 2011 high of 1911/20.

Silver severely overbought in short & longer term but definitely no sell signal. We could enter another consolidation phase but will buy into any profit-taking to support levels. Minor support at 2205 with better support at 2188/84.

Watch for a low for the day. However, if we continue lower try longs at 2159/55 with stops below 2147.

Bulls in control so a break above 2040 targets 2080/85 & 2300/05, perhaps as far as 2535/39. If we continue higher look for 2346/49 & 2390/95.

Trends

- Weekly Outlook Positive

- Daily Outlook Positive

- Short Term Outlook Positive