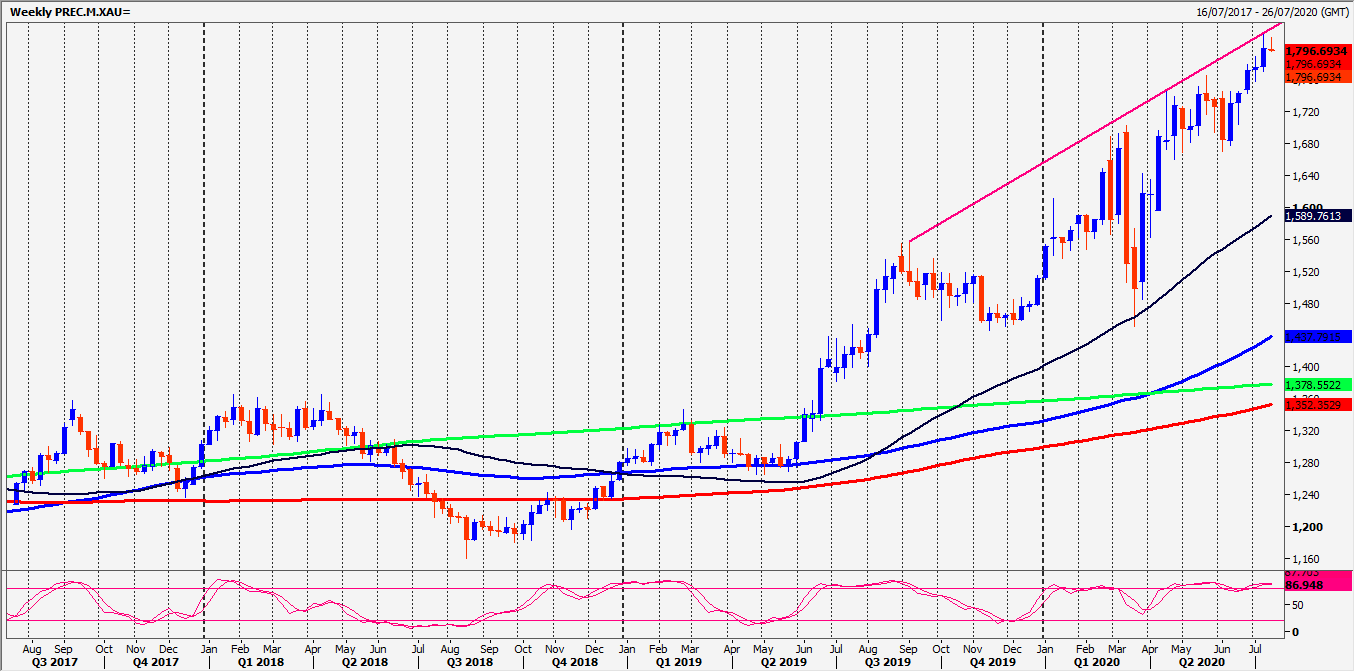

Gold Spot longs at our buying opportunity at 1796/94 worked perfectly as we target 1806/07 and 1812/14 for a potential 16/18 point profit on this scalping opportunity.

Silver Spot in a 2 steps forward, 1 step back trend. We bounced just 4 points above the best support today at 1880/77.

Today’s Analysis

Gold longs work perfectly again with our magic support at 1796/94 as we hit the 1812/14 target as hoped. Further gains always possible for a retest of 1817 high, with the next targets of 1825/27 and 1835/37.

A buying opportunity again at 1796/94. Longs need stops below 1791. A break lower is a small sell signal & risks a slide to 1784/82. Try longs with stops below 1778.

Silver bounced from just above best support today at 1880/77 beats 1900 to keep bulls in control re-targeting 1930/35. A break higher targets the 2019 high of 1960/65. Obviously this is key. If we continue higher look for 2000/05.

Best support again at 1880/77. Longs need stops below 1870. The next downside target and buying opportunity in the bull trend is at 1844/40, stop below 1835.

Trends

- Weekly outlook is positive

- Daily outlook is positive

- Short Term outlook is neutral