- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

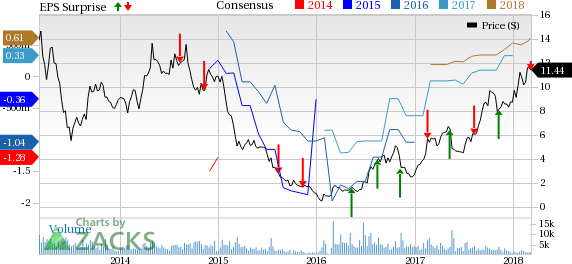

GOL Linhas (GOL) Q4 Earnings Lag, Revenues Beat Estimates

GOL Linhas Aereas Inteligentes S.A. (NYSE:GOL) has reported lower-than-expected earnings but better-than-expected revenues in the fourth quarter of 2017.

The company’s earnings per share (excluding 23 cents from non-recurring items) of 24 cents missed the Zacks Consensus Estimate of 25 cents. While in the year-ago quarter, the company had reported a breakeven earnings figure.

The bottom-line miss seems to have disappointed investors. Consequently, the stock fell 2.1% at the close of business on Mar 7.

Net sales, comprising cargo and passenger revenues, came in at $917.3 million (R$3 billion), surpassing the Zacks Consensus Estimate of $911.1 million. The top line grew 11.8% on a year-over-year basis on the back of higher demand for air travel as well as improved pricing. While cargo revenues increased 15%, passenger revenues rose 11.4%.

Operational Statistics

Total revenue passenger kilometers (RPK), measure of revenues generated per kilometer per passenger, climbed 8% year over year. While international RPK increased 9.2%, the metric on the domestic front gained 7.9%.

Consolidated available seat kilometers (ASK), measuring an airline's passenger carrying capacity, expanded 3.5% year over year. This upside was attributable to 9.6% growth in international ASK. The same was up 2.8% on the domestic front.

During the reported quarter, this Latin-American carrier’s total load factor (percentage of seats filled with passengers) was 81% compared with 77.6% a year ago, owing to capacity expansion outweighing traffic rise.

Average fare at this Sao Paulo-based airline increased 4.9% while average yield per passenger improved 3.1%. Net passenger revenue per available seat kilometers (PRASK) rose 7.6% while net operating revenue per available seat kilometers (RASK) was up 8%, aiding the top line. Cost per available seat kilometers (CASK) excluding fuel costs decreased 4.6% in the period under review.

Financials

GOL Linhas exited the quarter with cash and cash equivalents of R$1,026.86 million compared with R$562.21 million at year-end 2016. Additionally, long-term debt totaled R$5,942.8 million at the quarter-end compared with R$5,543.9 million at the end of 2016.

Operating expenses rose 4.9% to R$2,590.5 million, mainly due to a 21.2% rise in aircraft fuel. Both total volume of departures and seat strength available inched up 1.6% on a year-over-year basis.

2018 & 2019 Outlook

The company expects capacity to rise between 1% and 3% in 2018 while the metric is projected to increase 5-10% in 2019. Additionally, total fleet size is estimated at 118 in 2018 and for 2019, between 122 and 124. Also, the volume of departures is anticipated to grow between 1% and 3% for the current year. The same is estimated to rise in the band of 2-5% in 2019.

Another important metric, load factor (percentage of seats filled by passengers), is predicted to be between 79% and 80% in 2018, while for 2019, the same is estimated in the range of 79-81%. Going forward, we expect the company’s focus on capacity discipline to result in increasing its yields.

Operating earnings before interest and taxes (EBIT) margin, a measure for the company's earnings ability, is estimated at around 11% this year whereas 13% for the metric is predicted next year. While EBITDA (earnings before interest, taxes, depreciation and amortization) margin is anticipated at approximately 16% in 2018, the metric is likely to be around 18% in 2019.

Zacks Rank & Key Picks

GOL Linhas carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the airline space are International Consolidated Airlines Group (LON:ICAG) SA (OTC:ICAGY) , Delta Air Lines, Inc. (NYSE:DAL) and Southwest Airlines Co. (NYSE:LUV) . While International Consolidated Airlines sports a Zacks Rank #1 (Strong Buy), Delta Air Lines and Southwest Airlines carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of International Consolidated Airlines, Delta Air Lines and Southwest Airlines have gained more than 7%, 12% and 8%, respectively, in the last six months.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Southwest Airlines Company (LUV): Free Stock Analysis Report

Gol Linhas Aereas Inteligentes S.A. (GOL): Free Stock Analysis Report

Delta Air Lines, Inc. (DAL): Free Stock Analysis Report

International Consolidated Airlines Group SA (ICAGY): Free Stock Analysis Report

Original post

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.