EUR/USD has edged higher in Friday trading, as the pair trades slightly above the 1.36 line. Eurozone numbers were weak, as German Retail Sales declined 0.8% in October. French Consumer Spending also looked sluggish, with a 0.2% decline. Eurozone CPI Flash Estimate and Unemployment Rate will be released later in the day. US markets will be closing early on Friday, and there are no US releases on the schedule.

The German economy, Eurozone's largest, continues to post mixed releases. Retail Sales, the most important consumer spending indicator, dropped 0.8% in October, well off the estimate of a 0.5% gain. The key indicator has been struggling, posting its fourth decline in the past five months. This release comes on the heels of a weak German unemployment claims release on Thursday. On a brighter note, the October Business Climate and Consumer Climate readings were solid and CPI, although not strong, edged higher than the estimate.

For a second straight week, US Unemployment Claims dropped and came in lower than market expectations, although the euro managed to hold its own despite this. The key indicator dropped to an eight-week low of 316 thousand, easily beating the estimate of 331 thousand. With increasing speculation about a QE taper, employment releases will remain under the market microscope. If employment numbers continue to improve, we can expect the Fed to scale down QE early in 2014, which would likely give a big boost to the US dollar.

We've heard plenty about the lack of inflation and growth in the Eurozone, and the ECB is considering further monetary action to shake the economy out of its slumber. Despite all this, the euro continues to look good, and has gained about 250 points against the US dollar in the last two weeks, as it trades around the 1.36 level. However, the euro still is well below the levels we saw in late October, when EUR/USD was trading around 1.38.

With inflation remaining very weak despite recent rate cuts, the ECB is considering cutting the deposit rate, which currently stands at 0.0%. However, a move into negative territory would represent unchartered territory and could have negative consequences for the economy. So if the ECB does go ahead and reduce to deposit rate, we could see a "mini cut" of less than 0.25%. The OECD has also expressed concern about the dangers of deflation in the Eurozone and has urged the ECB to consider implementing quantitative easing, which has been used extensively by central banks such as the Federal Reserve and the Bank of England. EUR/USD" border="0" height="300" width="400">

EUR/USD" border="0" height="300" width="400">

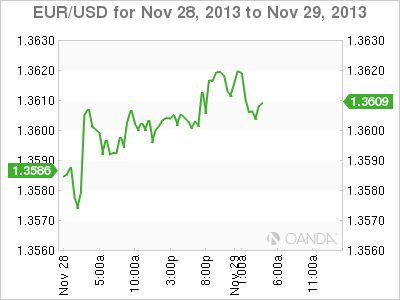

EUR/USD November 29 at 9:20 GMT

EUR/USD 1.3611 H: 1.3622 L: 1.3599

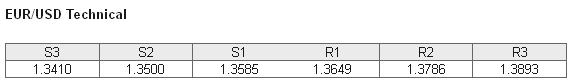

- EUR/USD has edged higher in Friday trading as the proximate support and resistance levels (S1 and R1 above) remain intact.

- On the downside, the 1.3585 is providing support. This is a weak line which could face pressure during the day. This is followed by a support line at the round number of 1.3500.

- The pair continues to face resistance at 1.3649. Next, there is resistance at 1.3786, which has remained intact since late October.

- Current range: 1.3585 to 1.3649

Further levels in both directions:

- Below: 1.3585, 1.3500, 1.3410, 1.3325 and 1.3265

- Above: 1.3649, 1.3786, 1.3893 and 1.4000

OANDA's Open Positions Ratio

EUR/USD ratio has reversed positions in Friday trading and is pointing to gains in short positions. This is not reflected in the pair's movement, as the euro continues to post slight gains. A large majority of the open positions remain short, indicative of a trader bias towards the dollar reversing direction and posting gains against the euro.

The euro remains at high levels, trading close to the 1.36 line. With no US releases on Friday, we can expect limited movement from EUR/USD during the day.

EUR/USD Fundamentals

- 7:00 German Retail Sales. Exp. 0.5%. Actual -0.8%.

- 7:45 French Consumer Spending. Exp. 0.3%. Actual -0.2%.

- 9:00 Italian Monthly Unemployment Rate. Exp. 12.5%.

- 9:00 Italian Quarterly Unemployment Rate. Exp. 12.2%.

- 10:00 Eurozone CPI Flash Estimate. Exp. 0.8%.

- 10:00 Eurozone Unemployment Rate. Exp. 12.2%.

- 10:00 Italian Preliminary CPI. Exp. 0.2%.