- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

General Dynamics Wins $198M Deal To Manufacture DMR Systems

General Dynamics Corp’s (NYSE:GD) Mission Systems business recently won a contract for the procurement, manufacturing, testing and delivery of the AN/USC-61(C) Digital Modular Radio (DMR) systems. The defense major will also supply high frequency distribution amplifier group components, spare parts and engineering services to support field and maintenance work.

Closer Look at the Deal

Valued at $198 million, the contract was awarded by the Space and Naval Warfare Systems Command, San Diego, CA. Work will be executed in Scottsdale, AZ, and is scheduled to be over by Dec 2022.

General Dynamics will utilize fiscal 2017 shipbuilding and conversion (Navy) funds to complete the work. Notably, the cumulative value of the contract may go up to $209 million, if the options included in the contract are exercised.

Details on DMR Systems

DMR is a modular, software defined reprogrammable radio system with embedded cryptography that provides all radio frequencies (RF) to-baseband and baseband-to-RF conversion functions required for line-of-sight (LOS). It offers multiple waveforms and multi-level information security for voice and data communications using frequencies ranging from 2.0 megahertz to 2.0 gigahertz.

Notably, General Dynamics’ AN/USC-61 (C) DMR is the first software defined radio to become a communications system standard for the U.S. Military.

Our View

General Dynamics’ Mission Systems unit is a leading integrator of mission critical C4ISR solutions across the land, sea, air, space and cyber domain. This unit falls under the company's Information Systems & Technology (IS&T) segment, which offers high-assurance mission and display systems, signal and sensor processing and command-and-control solutions for airborne platforms. Its aircraft mission computers are installed in the Navy's F/A-18 Super Hornet strike fighter and Marine Corps' AV-8B Harrier II aircraft, providing pilots with advanced situational awareness and combat systems control.

Currently, the company’s DMR operates overseas on the U.S. Navy surface and sub-surface vessels, fixed-sites and other Department of Defense communication platforms. Although IS&T segment revenues declined year over year in the third quarter of 2017, management forecasts strong fourth-quarter results from this segment. This may have been driven by expectations of strong DMR demand. The latest contract win is reflective of this bullishness.

Considering the favorable defense budget scenario in the United States, we expect General Dynamics to win more such contracts, which in turn will boost the IS&T segment further.

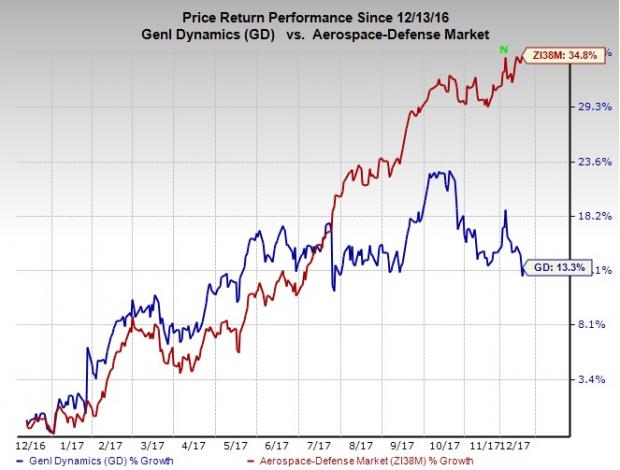

Price Performance

Shares of General Dynamics have rallied about 13.3% in a year, compared with the broader industry’s 34.8%. Budget cuts by the prior government have probably led to the underperformance.

Zacks Rank & Key Picks

General Dynamics carries a Zacks Rank #3 (Hold). A few better-ranked stocks from the same sector are Curtiss-Wright Corporation (NYSE:CW) , Leidos Holdings, Inc. (NYSE:LDOS) and Huntington Ingalls Industries, Inc. ( (NYSE:HII) ). While Curtiss-Wright sports a Zacks Rank #1 (Strong Buy), Leidos Holdings and Huntington Ingalls carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Curtiss-Wright posted an average positive earnings surprise of 11.78% for the past four quarters. The Zacks Consensus Estimate for current-quarter earnings rose by 22 cents over the last 60 days.

Leidos Holdings has an average positive earnings surprise of 14.81% for the past four quarters. The Zacks Consensus Estimate for current-year earnings has improved by a penny in the past 30 days.

Huntington Ingalls posted an average positive earnings surprise of 14.22% for the last four quarters. The Zacks Consensus Estimate for current-year earnings has risen by 48 cents in the past 60 days.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

General Dynamics Corporation (GD): Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII): Free Stock Analysis Report

Leidos Holdings, Inc. (LDOS): Free Stock Analysis Report

Curtiss-Wright Corporation (CW): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.