USD/JPY has posted small losses in the Wednesday session. In North American trade, the pair is trading at 112.31, down 0.12% on the day. On the release front, Japanese Preliminary Tool Orders impressed with a reading of 45.3% in September, up from 36.3% a month earlier. Later in the day, Japan releases the Producers Price Index, which is expected to edge up to 3.0%. In the US, JOLTS Job Openings is expected to ease slightly to 6.13 million. Today’s highlight is the Federal Reserve minutes from the September policy meeting.

Japan’s current account surplus climbed to JPY 2.27 trillion in August, marking the highest monthly surplus since 2007. The strong reading points to an increase in exports, thanks to the weak Japanese currency and strong global demand for Japanese products. Still, chronically weak inflation remains a sore point, and the Bank of Japan has acknowledged that it does not expect its inflation target of just below 2.0% percent to be reached before 2020.

On Tuesday, a BoJ report gave a thumbs-up to the economy, noted that exports were strong and consumer spending and construction had strengthened. Despite improving economic conditions, BOJ Governor Haruhiko Kuroda reiterated a familiar message on Tuesday, saying that the bank will continue its ultra-loose stimulus program until inflation moves above its target of 2 percent.

The Federal Reserve will release its minutes from the September meeting. At the September meeting, the Fed did not raise interest rates but did announce it would begin trimming its $4.2 billion balance sheet in October. This is seen as a vote of confidence in the US economy, which continues to show strong growth. At time of the September meeting, the odds of December rate hike were pegged around 50 percent. However, the odds have now surged to 91 percent.

The primary reason for the huge shift in market sentiment can be attributed to Fed policymakers coming out in support of a rate hike, notably Fed Chair Janet Yellen. The lack of inflation remains the most significant impediment to raising rates, but Yellen and other FOMC members have insisted that strong economic conditions will lead to higher inflation levels. Even if inflation does not move higher before 2018, the Fed now appears ready to raise rates for a third and final time this year.

USD/JPY Fundamentals

Wednesday (October 11)

- 1:58 Japanese Preliminary Tool Orders. Actual 45.3%

- 10:00 US JOLTS Openings. Estimate 6.06M

- 14:00 US FOMC Meeting Minutes

- 19:50 Japanese Bank Lending. Estimate 2.6%

- 19:50 Japanese PPI. Estimate 3.0%

Thursday (October 12)

- 8:30 US PPI. Estimate 0.4%

- 8:00 US Unemployment Claims. Estimate 251K

*All release times are GMT

*Key events are in bold

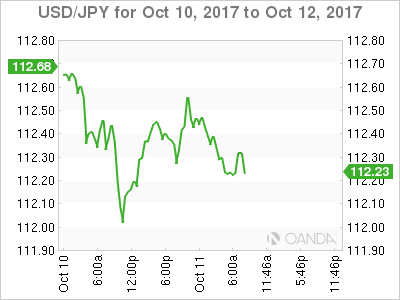

USD/JPY for Wednesday, October 11, 2017

USD/JPY October 11 at 7:10 EDT

Open: 112.45 High: 112.59 Low: 112.19 Close: 112.31

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 108.69 | 110.10 | 110.94 | 112.57 | 113.55 | 114.49 |

USD/JPY showed limited movement in Asian trade and has edged lower in the European session

- 110.94 is providing support

- 112.57 was tested earlier in resistance

Current range: 110.94 to 112.57

Further levels in both directions:

- Below: 110.94, 110.10 and 108.69

- Above: 112.57, 113.55, 114.49 and 115.50

OANDA’s Open Positions Ratios

USD/JPY ratio remains almost unchanged this week. Currently, long positions have a majority (57%), indicative of trader bias towards USD/JPY reversing directions and moving to higher ground.