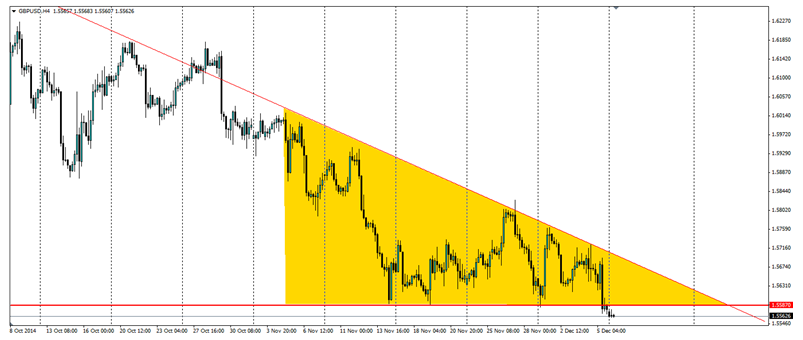

The Pound has had another tough week that has resulted in a breakout of the main support level of the descending triangle. A pullback close to this level will be a good trigger for an entry as a breakout-pullback play.

The pound took a hammering at the end of last week as the US Non-farm payrolls came in well above expected at 321k vs 228k. We even saw a revision upwards of last month’s result from 214k to 243k. The US economy certainly looks strong and the FED is only going to come under more pressure in the future to act on interest rates.

The UK on the other hand is performing well, but inflation is not a threat. Last week we saw the Services PMI (representing 80% of the UK economy) return a strong result, up from 56.2 to 58.6. Unfortunately for the Pound, inflation is not likely to threaten in the medium term, which is why the Bank of England held interest rates on hold last week. The interest rate outlook is also forcing the Pound to depreciate against the Dollar, and the bearish trend looks set to hold.

Last week also saw a breakout of the consolidation pattern. The descending triangle is a bearish signal and that certainly played out nicely with the bearish trend line holding firm. The support at 1.5587 came under immense selling pressure and the price broke out. This is now set up for a classic breakout-pullback play.

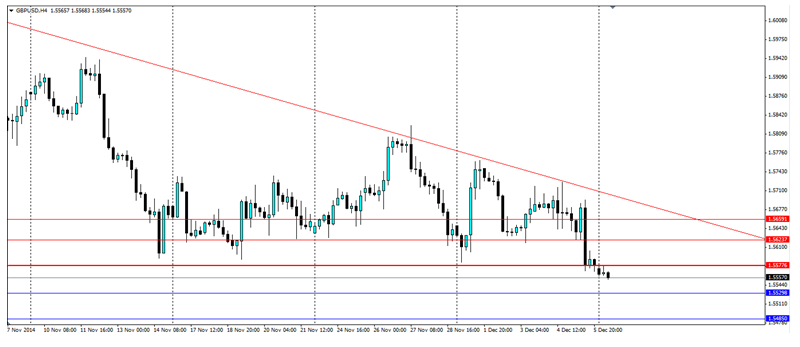

Look for an entry on a short position on the pullback close to the previous support level at 1.5587 as this will now act as resistance. A stop loss should be set not far over this to mitigate against a break back into the shape. Any of the support levels will act to hold up the price as it moves down. These can be found at 1.5529, 1.5485 and 1.5425.

The Pound has broken out of the descending triangle against the US Dollar. If we see a pull back to the previous support level, this could be a trigger for a short position to catch a larger movement lower.