- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

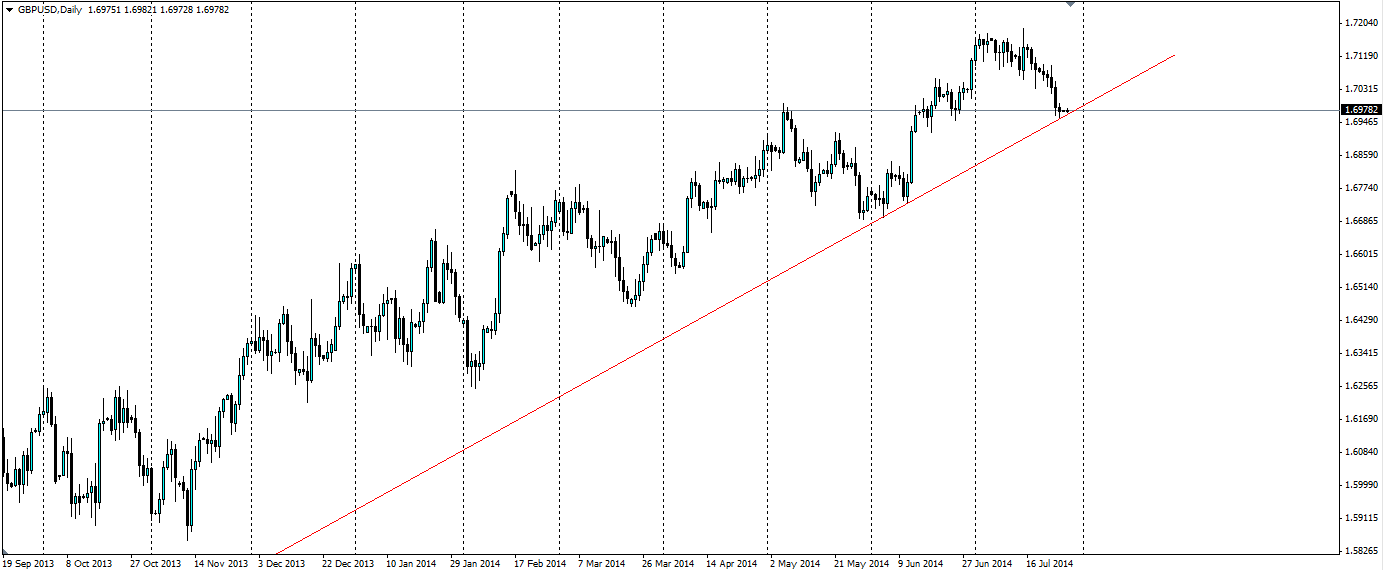

GBP/USD Close To Trend Line

The Pound has given back all of the gains made early in the month and is now on the trend line. There is not a great deal of news in the market early this week so it is likely to play off technicals, in which case we can expect a bounce off the trend line and a movement higher, however, later in the week it will be volatile.

The Pound has been on a bull run against the US Dollar for over a year as the outlook for the UK looks ever betterdespite the US having its own economic recovery. Recently however, the pound has given back some gains as the timing of potential interest rate rises in the UK still remains unclear and as the US Federal Reserve Chairwoman Janet Yellen gave Dollar bulls hope by saying that US interest rates will rise sooner than expected if the labour market continues to improve.

Inflation in the UK is not really posing a threat at 1.9% annually, however GDP is looking solid at 0.8% per quarter. Essentially there is no desperate need for the Bank of England to raise interest rates, however minutes from their recent meeting suggested that members see diminished risks to growth from a rate increase. This opens the door for the Bank of England to possibly begin to outline a timeframe for a rate increase, which will certainly boost the Pound.

This week will begin quietly for the pound, however, come Friday we have the UK manufacturing PMI figures and the biggest event of all; the US Nonfarm Payroll data. The US is expected to have added 230,000 jobs this month, down slightly on the 288,000 last month, but nonetheless a robust figure if it comes to fruition. This will add plenty of volatility to the market so traders should beware.

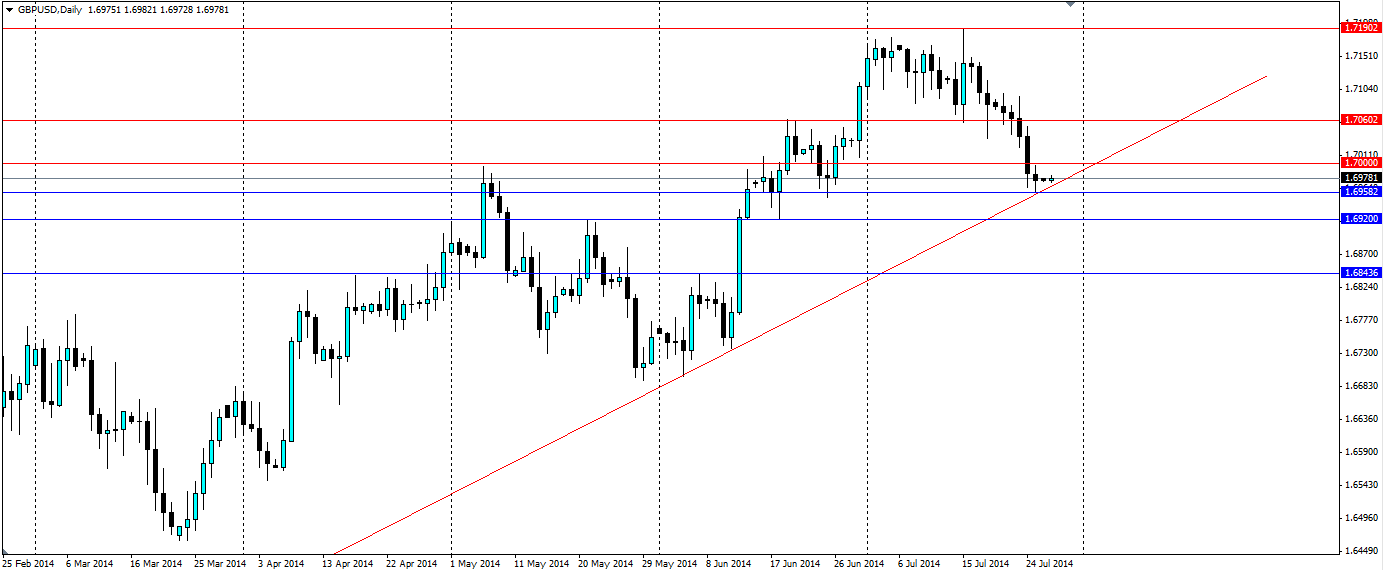

Up until Friday, we should see the GBP/USD pair trade off technicals and the most obvious movement is a bounce off the bullish trend line. The price appears to have touched the trend line at the end of last week and found support at the 1.6958 mark. Once the resistance is broken above the 1.7000 mark, we should see a relatively quick movement up to previous levels and to even test the five year high recently posted.

Traders could look to enter once this resistance is broken, with a stop loss below the trend line, in case there is a breakout lower. Several targets can be chosen for a movement higher, with previous resistance at 1.7060 being the first. The previous five year high at 1.7190 will also be a likely target.

The bullish trend line on the GBP/USD is likely to come into play this week and a bounce higher is the probable outcome. US Nonfarm Payroll data is likely to provide volatility at the end of the week and is something traders should keep an eye on.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.