Sterling suffered its worst day in 5 weeks against the euro yesterday, smashing through the bottom of the range it has occupied since the beginning of the year and currently trades at a near 10 week low. The reasons behind the decline are fairly simple: the Bank of England’ minutes and strength of the euro via the oil markets.

The Bank of England’s record of causing the pound to weaken continued yesterday with the latest minutes showing that 2 members of the MPC agreed with us that £75bn of additional asset purchases should have been utilised as opposed to the consensus view of £50bn. David Miles and Adam Posen, the two most dovish members of the committee, voted for the increase arguing that there was a risk of a prolonged period of depressed demand that would cause inflation to fall below target in the short term.

As I have said before, we think that 2012 is the year that inflation does finally start to move lower and QE will be instrumental in ensuring that a slip into deflation does not materialise. Falling prices seems like a good thing for you and me; unfortunately the accompanying shift in demand and expectations of further price falls would later prove to be a more painful problem than most would think. It sets up May’s decision to be another split vote if the economy progresses at a similar rate.

One thing that could bring the recovery to a halt is a spike in the price of oil; a spike that is happening as we speak. Brent crude hit a record high in sterling terms yesterday. The heightened fears about Iran came after the nuclear watchdog, the IAEA, described a meeting that it had with officials in Tehran as “disappointing”.

The increase in supply chain inflation from a spike in oil prices can hammer corporate profitability and stymie efforts from central banks to keep monetary policy loose. The European Central Bank, a bank that is more fearful of inflation than most, may have to pause its cycle of rate cuts should prices move higher, hurting the European recovery. Nobody benefits, apart from oil producers and bicycle manufacturers, from higher oil costs.

Away from sterling we once again have news from Greece in a vote from parliament over further details of the PSI deal although this is unlikely to cause many ripples.

Following yesterday’s below par PMI numbers from Germany, fears have crept in to European assets that January’s move higher may have just been a blip. While both services and manufacturing expanded in Germany through February, they missed expectations. Today’s IFO business climate number will give us a boiled down version as to the sentiment in country, it is expected to continue its 4 month trend of improvement when released at 09.30.

Data from the US comes in the form of initial jobless claims and traders will once again look for signs of an improving picture in the US jobs market. Last week’s was the best figure for 4 years although a slight rise is expected this week. Claims are published at 13.30.

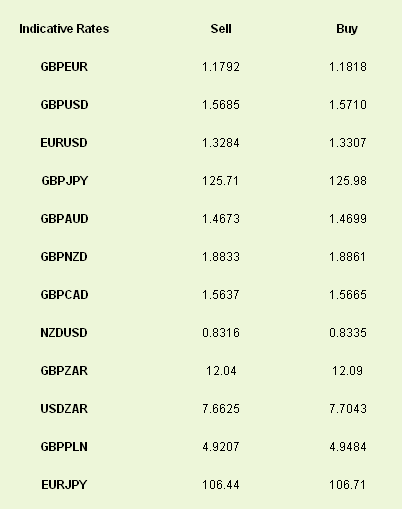

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

GBP/EUR Hits 10 Week Low on Minutes and Oil Flows

Published 02/23/2012, 06:38 AM

Updated 07/09/2023, 06:31 AM

GBP/EUR Hits 10 Week Low on Minutes and Oil Flows

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.