- The appetite for safe-haven Treasuries grows ahead of Thursday’s Brexit vote

- Global equity markets are facing new headwinds amid heightened macro worries

- Is the yen’s rally living on borrowed time?

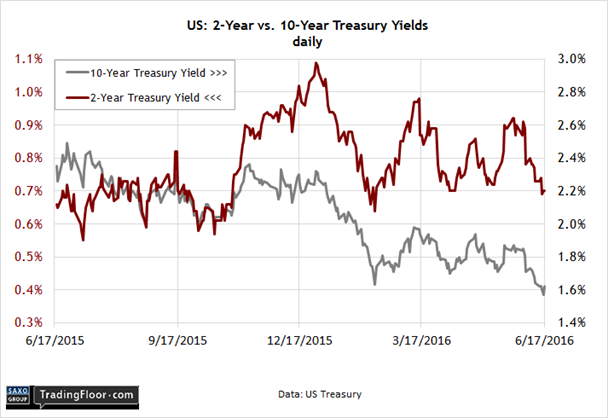

It’s a slow day for scheduled economic news and so the focus turns to market signals. On the short list is the 10-year Treasury yield, which fell last week, although it recovered a bit on Friday.

Meanwhile, global stockmarkets are facing new headwinds as economic worries take centre stage. Is the latest wobble just a round of temporary anxiety ahead of the Brexit vote this Thursday or the precursor for an ugly summer for equities?

The crowd will be watching this week's trading--particular Friday's post-Brexit reaction for clues.

10-Year Treasury Yield: Will gravity continue to pull down the benchmark 10-year yield this week? The rearview mirror suggests as much. Downside momentum was on display last week. Buyers briefly pared the 10-year yield below 1.60% for the first time since late 2012, based on daily data from Treasury.gov, before the rate revived a bit on Friday.

Even so, the benchmark yield slipped on the week. Thanks in part to the Federal Reserve’s decision to postpone a rate hike - again - the crowd piled into safe-haven Treasuries.

Mixed reports on the US economy were also a factor in reviving a risk-off bias. Ditto for worries about this week’s Brexit vote.

Some polls show an edge for the “leave” campaign, which favours the UK’s exit from the Europe Union, an outcome that many economists could be costly for Britain's economy with repercussions in Europe and perhaps the US too.

In the current climate, with growing uncertainty on the economic and geopolitical fronts, there’s a renewed appetite for safety.

Although the US 10-year is close to an all-time low of roughly 1.40%, that’s still a comparatively rich yield from Europe’s perspective. Indeed, the German 10-year bund, after dipping just below zero for a bit last week, ended on Friday at just 0.02%.

“We’re the only one with yields,” said a senior Treasury trader in New York at Mitsubishi UFJ Securities. “If rates continue to go more negative [in Europe and elsewhere], there will be more demand for 10 year [Notes] over here.”

In that case, the 10-year yield may dip convincingly below 1.60% this week. In turn, there's a possibility that we’ll see a new all-time low for the US benchmark rate at some point in the near future.

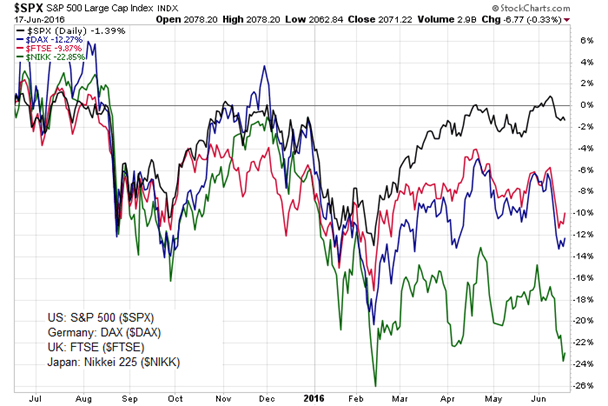

Global Equity Markets: Considering the revival for safe assets lately, it’s no surprise that the spring rebound in equity markets around the world has stumbled in June. Accordingly, if the crowd continues to chase government bonds as an antidote to fear, which will push yields even lower, expect to see stock markets remain on the defensive.

It’s telling that four of the world's most widely followed equity benchmarks for the US, Germany, Japan and the UK, are showing fresh signs of faltering. The weakness is especially conspicuous in the S&P 500, the US benchmark. After a solid rally in May and this month’s first half, the bears have resumed control.

Most of the major market indices stumbled last week, although the buyers returned on the margins on Thursday and Friday. Germany’s Dax and the US S&P 500, for instance, managed to close above their lows last week, but still eased for the five trading days up to Friday.

It’s not yet clear if the slide has run its course. With only a modest schedule for economic reports this week, trading could be volatile as the crowd looks for direction about the next wave of signals from the macro trenches. The main event, of course, is the Brexit vote on Thursday.

The potential for blowback may be over-hyped by the bears, but there’s a real danger that a UK decision to leave the EU will trigger more selling as the crowd fears the worst.

Therein lie the seeds for profitable contrarian trades, depending on how far the selling goes. In the meantime, equities face a challenging week as geoeconomic worries, reasonable or not, go into overdrive.

In the grand scheme of economic factors, Brexit may end up as a relatively minor event. But “in a low-growth environment, even smaller problems become more pronounced”, notes a senior portfolio manager at US Bank's Private Client Reserve unit.

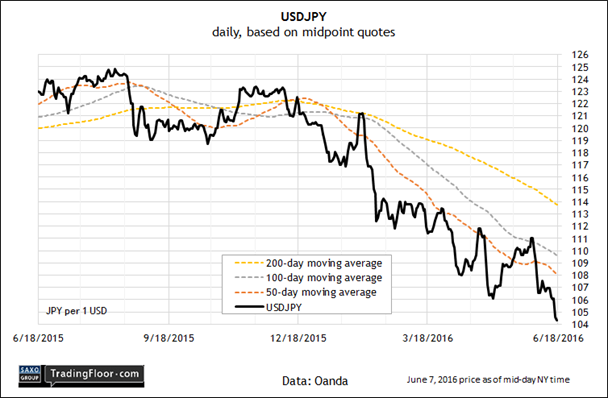

USD/JPY: A week ago I wrote that USD/JPY’s decline below ¥106 could signal a new run lower. As it turned out, USD/JPY fell through that line last Monday and kept on going, ending the week at just above ¥104.

Several factors are powering the yen’s strength, including the Fed’s decision to forgo a rate hike last week and the Bank of Japan’s lack of enthusiasm (so far) for intervening in currency markets and nipping the yen’s bull run in the bud.

This week’s key factor, of course, is Thursday’s Brexit vote, which has been a driving force for risk aversion overall lately, which in turn has elevated asset flows into the yen, which is widely considered a safe haven currency.

But the longer the yen rallies, the greater the potential risk via a BoJ reaction. “It is certain that further gains in the yen could ruin the Japanese economy,” the chief economist at SMBC Nikko Securities said on Friday.

BoJ has continued to tolerate the currency’s bull market, but the macro threat that’s embedded in such a strong currency is rising. At some point, tolerance may give way to intervention.

Before the Brexit vote? Probably not. On the other side of June 23, by contrast, betting on continued yen strength will look increasingly risky.

Disclosure: Originally published at Saxo Bank TradingFloor.com